Authors

Summary

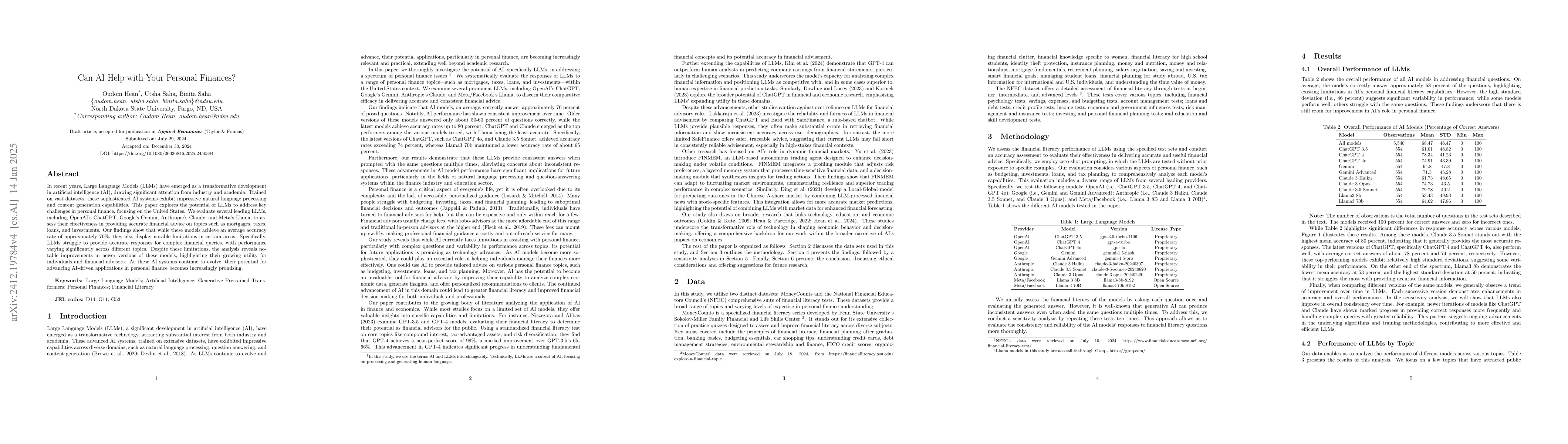

In recent years, Large Language Models (LLMs) have emerged as a transformative development in artificial intelligence (AI), drawing significant attention from industry and academia. Trained on vast datasets, these sophisticated AI systems exhibit impressive natural language processing and content generation capabilities. This paper explores the potential of LLMs to address key challenges in personal finance, focusing on the United States. We evaluate several leading LLMs, including OpenAI's ChatGPT, Google's Gemini, Anthropic's Claude, and Meta's Llama, to assess their effectiveness in providing accurate financial advice on topics such as mortgages, taxes, loans, and investments. Our findings show that while these models achieve an average accuracy rate of approximately 70%, they also display notable limitations in certain areas. Specifically, LLMs struggle to provide accurate responses for complex financial queries, with performance varying significantly across different topics. Despite these limitations, the analysis reveals notable improvements in newer versions of these models, highlighting their growing utility for individuals and financial advisors. As these AI systems continue to evolve, their potential for advancing AI-driven applications in personal finance becomes increasingly promising.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAre Large Pre-Trained Language Models Leaking Your Personal Information?

Jie Huang, Kevin Chen-Chuan Chang, Hanyin Shao

Can ChatGPT be Your Personal Medical Assistant?

Wajdi Zaghouani, Md. Rafiul Biswas, Zubair Shah et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)