Summary

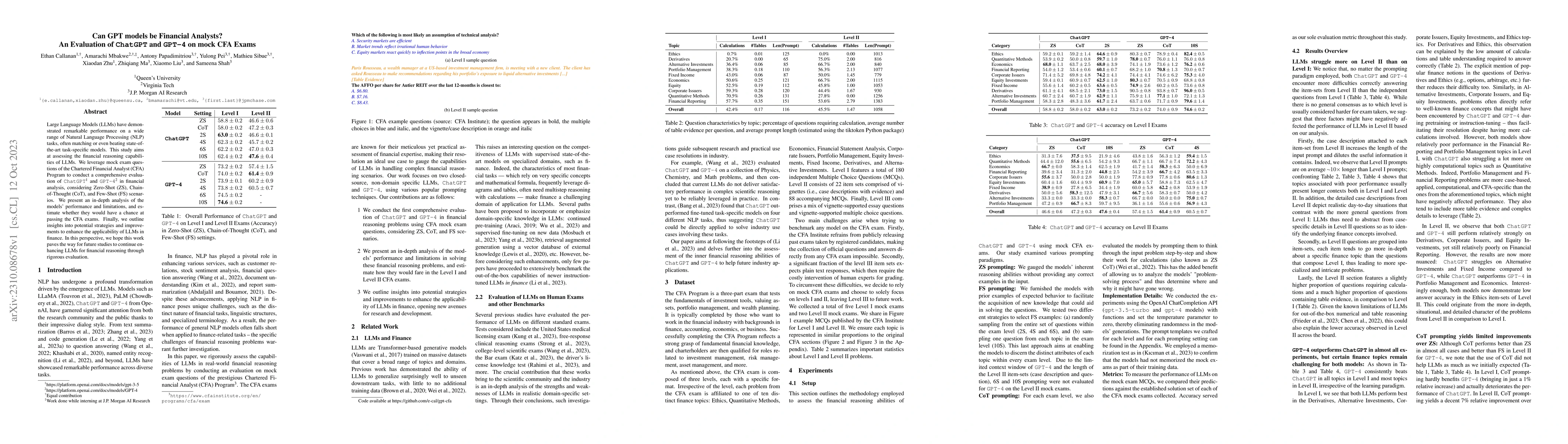

Large Language Models (LLMs) have demonstrated remarkable performance on a wide range of Natural Language Processing (NLP) tasks, often matching or even beating state-of-the-art task-specific models. This study aims at assessing the financial reasoning capabilities of LLMs. We leverage mock exam questions of the Chartered Financial Analyst (CFA) Program to conduct a comprehensive evaluation of ChatGPT and GPT-4 in financial analysis, considering Zero-Shot (ZS), Chain-of-Thought (CoT), and Few-Shot (FS) scenarios. We present an in-depth analysis of the models' performance and limitations, and estimate whether they would have a chance at passing the CFA exams. Finally, we outline insights into potential strategies and improvements to enhance the applicability of LLMs in finance. In this perspective, we hope this work paves the way for future studies to continue enhancing LLMs for financial reasoning through rigorous evaluation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEvaluating GPT-3.5 and GPT-4 Models on Brazilian University Admission Exams

Roberto Lotufo, Rodrigo Nogueira, Ramon Pires et al.

Can GPT models Follow Human Summarization Guidelines? Evaluating ChatGPT and GPT-4 for Dialogue Summarization

François Portet, Fabien Ringeval, Yongxin Zhou

GPT-4 as an Agronomist Assistant? Answering Agriculture Exams Using Large Language Models

Vijay Aski, Ranveer Chandra, Leonardo Nunes et al.

Evaluating GPT-4 and ChatGPT on Japanese Medical Licensing Examinations

Keisuke Sakaguchi, Dragomir Radev, Yutaro Yamada et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)