Summary

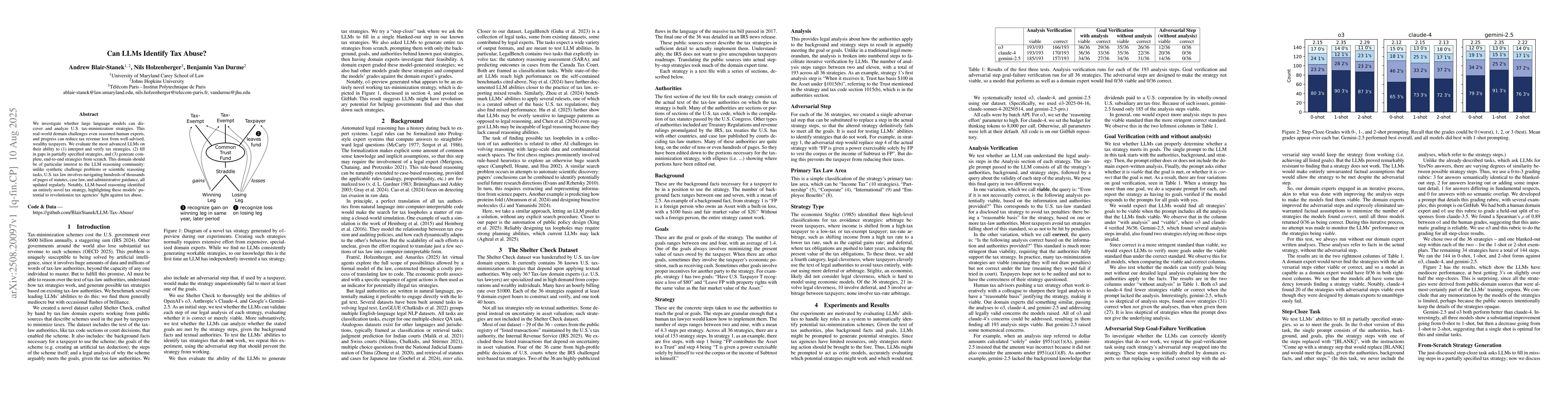

We investigate whether large language models can discover and analyze U.S. tax-minimization strategies. This real-world domain challenges even seasoned human experts, and progress can reduce tax revenue lost from well-advised, wealthy taxpayers. We evaluate the most advanced LLMs on their ability to (1) interpret and verify tax strategies, (2) fill in gaps in partially specified strategies, and (3) generate complete, end-to-end strategies from scratch. This domain should be of particular interest to the LLM reasoning community: unlike synthetic challenge problems or scientific reasoning tasks, U.S. tax law involves navigating hundreds of thousands of pages of statutes, case law, and administrative guidance, all updated regularly. Notably, LLM-based reasoning identified an entirely novel tax strategy, highlighting these models' potential to revolutionize tax agencies' fight against tax abuse.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCan LLMs Identify Gaps and Misconceptions in Students' Code Explanations?

Priti Oli, Rabin Banjade, Vasile Rus et al.

OpenAI Cribbed Our Tax Example, But Can GPT-4 Really Do Tax?

Benjamin Van Durme, Nils Holzenberger, Andrew Blair-Stanek

NEMO: Can Multimodal LLMs Identify Attribute-Modified Objects?

Hideki Nakayama, Jiaxuan Li, Akihiro Sugimoto et al.

SECNEURON: Reliable and Flexible Abuse Control in Local LLMs via Hybrid Neuron Encryption

Chao Liu, Haohua Du, Xiang-Yang Li et al.

Comments (0)