Summary

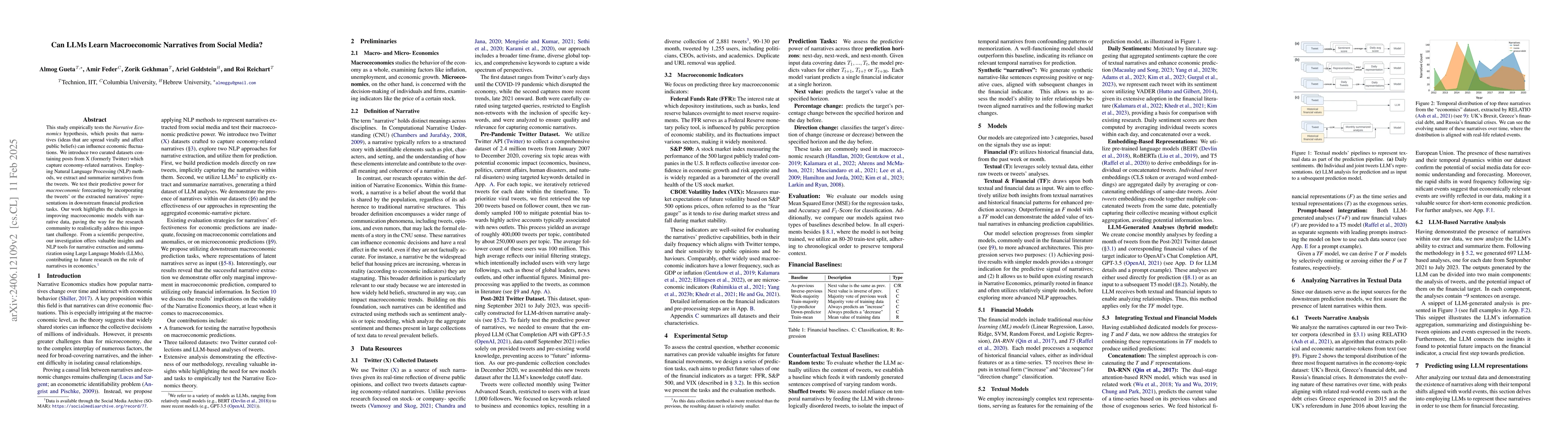

This study empirically tests the $\textit{Narrative Economics}$ hypothesis, which posits that narratives (ideas that are spread virally and affect public beliefs) can influence economic fluctuations. We introduce two curated datasets containing posts from X (formerly Twitter) which capture economy-related narratives (Data will be shared upon paper acceptance). Employing Natural Language Processing (NLP) methods, we extract and summarize narratives from the tweets. We test their predictive power for $\textit{macroeconomic}$ forecasting by incorporating the tweets' or the extracted narratives' representations in downstream financial prediction tasks. Our work highlights the challenges in improving macroeconomic models with narrative data, paving the way for the research community to realistically address this important challenge. From a scientific perspective, our investigation offers valuable insights and NLP tools for narrative extraction and summarization using Large Language Models (LLMs), contributing to future research on the role of narratives in economics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGenerative AI regulation can learn from social media regulation

Ruth Elisabeth Appel

Fact-Checking with Contextual Narratives: Leveraging Retrieval-Augmented LLMs for Social Media Analysis

Arka Ujjal Dey, Christian Schroeder de Witt, John Collomosse et al.

NarrationDep: Narratives on Social Media For Automatic Depression Detection

Imran Razzak, Hamad Zogan, Shoaib Jameel et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)