Summary

An empirical analysis, suggested by optimal Merton dynamics, reveals some unexpected features of asset volumes. These features are connected to traders' belief and risk aversion. This paper proposes a trading strategy model in the optimal Merton framework that is representative of the collective behavior of heterogeneous rational traders. This model allows for the estimation of the average risk aversion of traders acting on a specific risky asset, while revealing the existence of a price of risk closely related to market price of risk and volume rate. The empirical analysis, conducted on real data, confirms the validity of the proposed model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

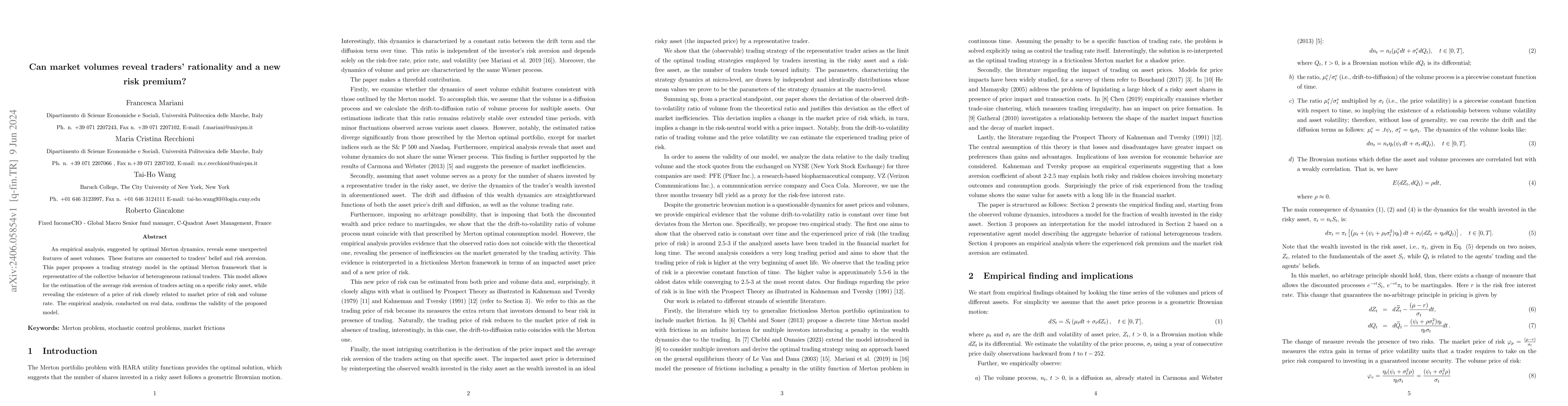

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Multi-agent Market Model Can Explain the Impact of AI Traders in Financial Markets -- A New Microfoundations of GARCH model

Masanori Hirano, Kei Nakagawa, Kentaro Minami et al.

No citations found for this paper.

Comments (0)