Summary

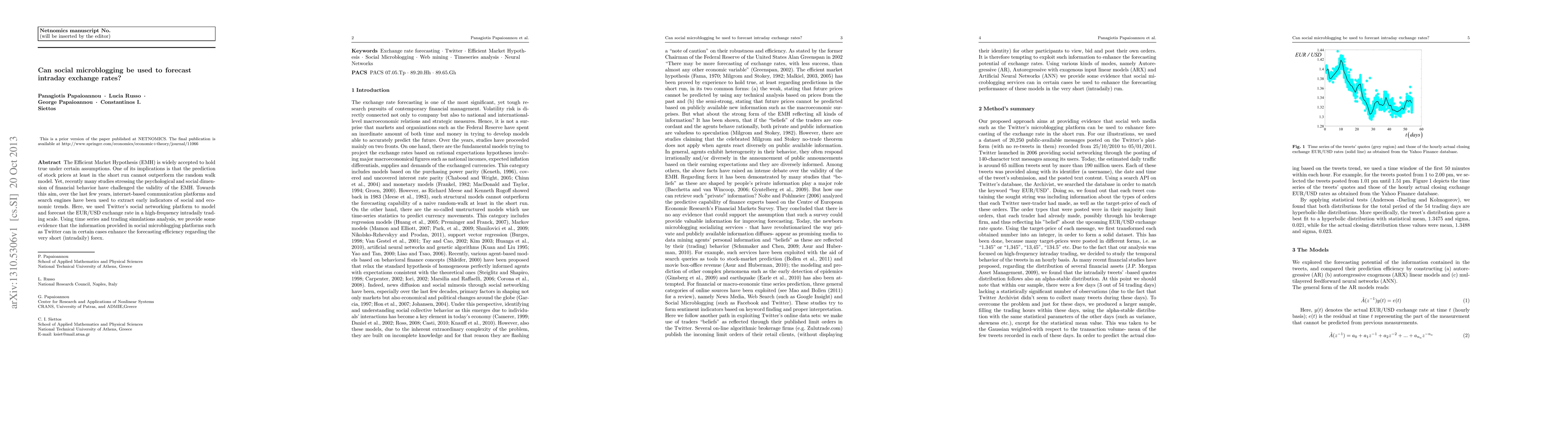

The Efficient Market Hypothesis (EMH) is widely accepted to hold true under certain assumptions. One of its implications is that the prediction of stock prices at least in the short run cannot outperform the random walk model. Yet, recently many studies stressing the psychological and social dimension of financial behavior have challenged the validity of the EMH. Towards this aim, over the last few years, internet-based communication platforms and search engines have been used to extract early indicators of social and economic trends. Here, we used Twitter's social networking platform to model and forecast the EUR/USD exchange rate in a high-frequency intradaily trading scale. Using time series and trading simulations analysis, we provide some evidence that the information provided in social microblogging platforms such as Twitter can in certain cases enhance the forecasting efficiency regarding the very short (intradaily) forex.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntra-day Solar and Power Forecast for Optimization of Intraday Market Participation

Alejandra Tabares, Nelson Salazar-Peña, Adolfo Palma-Vergara et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)