Authors

Summary

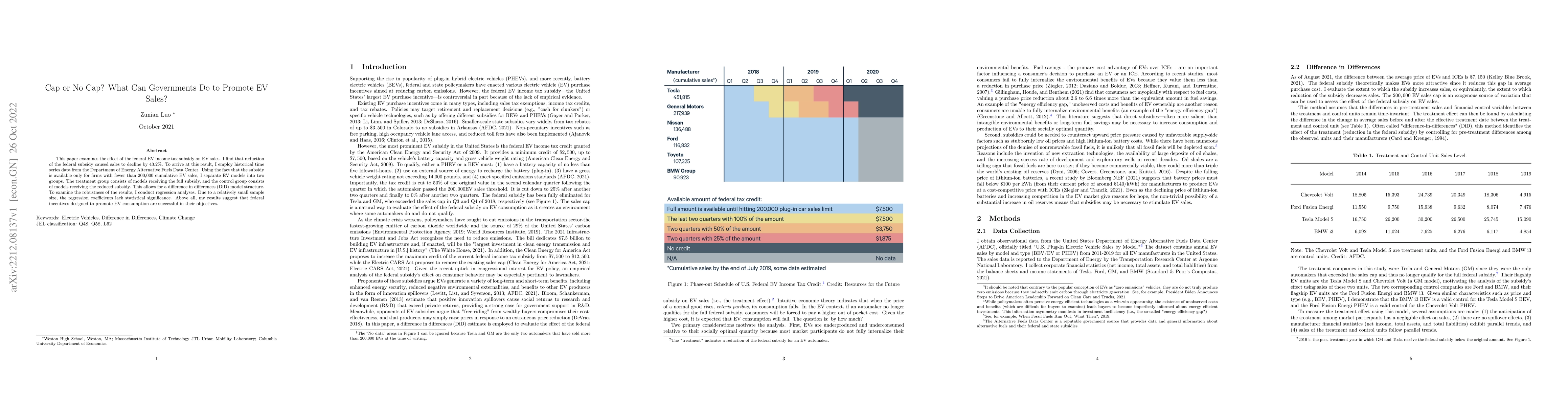

This paper examines the effect of the federal EV income tax subsidy on EV sales. I find that reduction of the federal subsidy caused sales to decline by $43.2 \%$. To arrive at this result, I employ historical time series data from the Department of Energy Alternative Fuels Data Center. Using the fact that the subsidy is available only for firms with fewer than 200,000 cumulative EV sales, I separate EV models into two groups. The treatment group consists of models receiving the full subsidy, and the control group consists of models receiving the reduced subsidy. This allows for a difference in differences (DiD) model structure. To examine the robustness of the results, I conduct regression analyses. Due to a relatively small sample size, the regression coefficients lack statistical significance. Above all, my results suggest that federal incentives designed to promote EV consumption are successful in their objectives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersClosed cap condition under the cap construction algorithm

Mercedes Sandu, Shuyi Weng, Jade Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)