Authors

Summary

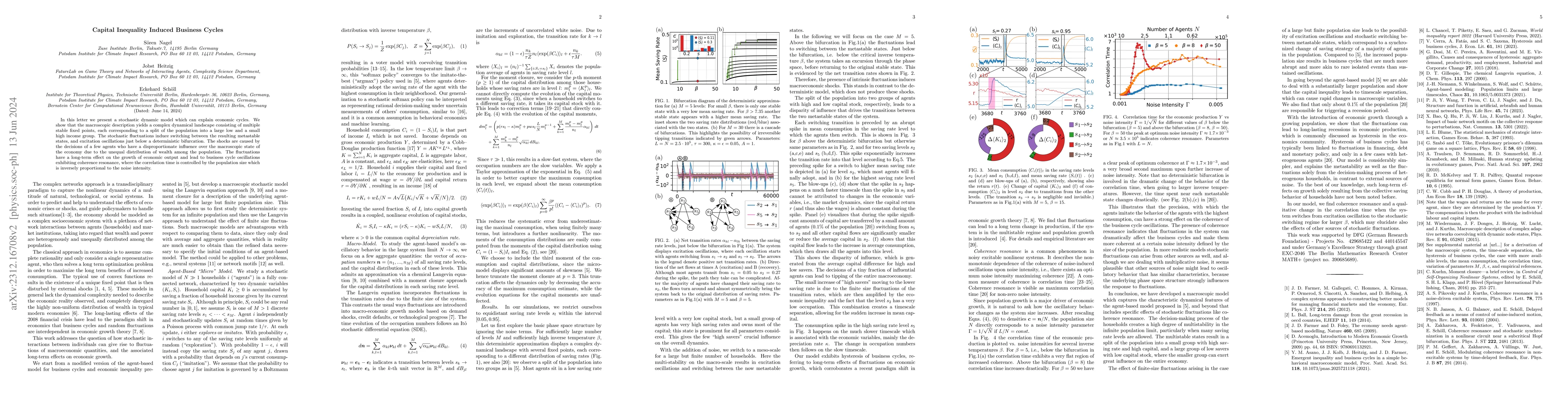

In this letter we present a stochastic dynamic model which can explain economic cycles. We show that the macroscopic description yields a complex dynamical landscape consisting of multiple stable fixed points, each corresponding to a split of the population into a large low and a small high income group. The stochastic fluctuations induce switching between the resulting metastable states, and excitation oscillations just below a deterministic bifurcation. The shocks are caused by the decisions of a few agents who have a disproportionate influence over the macroscopic state of the economy due to the unequal distribution of wealth among the population. The fluctuations have a long-term effect on the growth of economic output and lead to business cycle oscillations exhibiting coherence resonance, where the correlation time is controlled by the population size which is inversely proportional to the noise intensity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCapital Demand Driven Business Cycles: Mechanism and Effects

Michael Benzaquen, Karl Naumann-Woleske, Maxim Gusev et al.

The nonlinear economy (I): How resource constrains lead to business cycles

Giona Casiraghi, Frank Schweitzer

No citations found for this paper.

Comments (0)