Summary

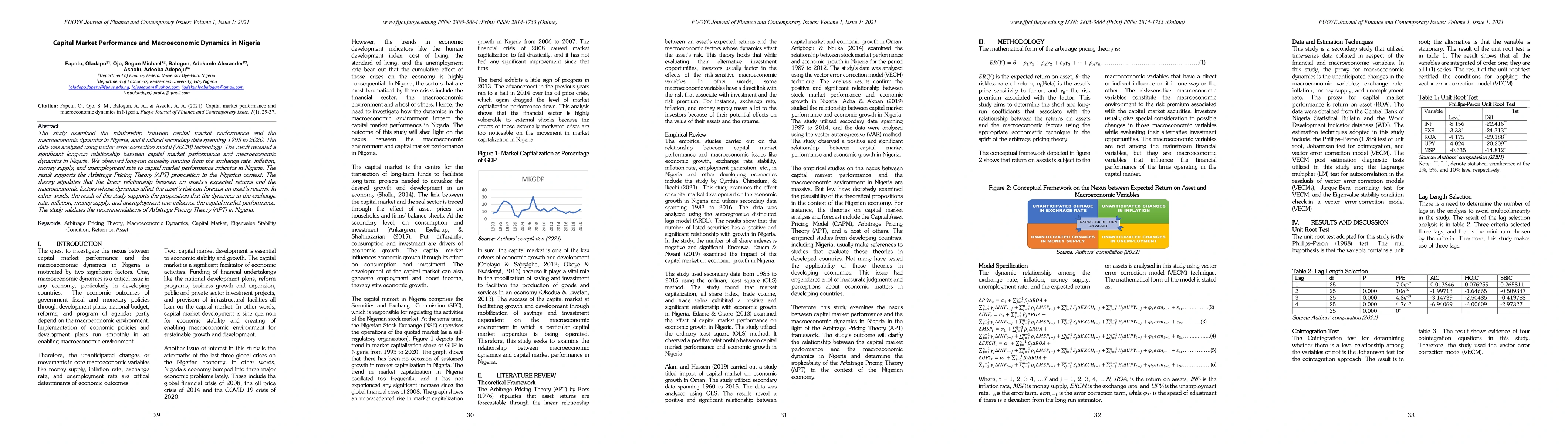

The study examined the relationship between capital market performance and the macroeconomic dynamics in Nigeria, and it utilized secondary data spanning 1993 to 2020. The data was analyzed using vector error correction model (VECM) technology. The result revealed a significant long run relationship between capital market performance and macroeconomic dynamics in Nigeria. We observed long run causality running from the exchange rate, inflation, money supply, and unemployment rate to capital market performance indicator in Nigeria. The result supports the Arbitrage Pricing Theory (APT) proposition in the Nigerian context. The theory stipulates that the linear relationship between an asset expected returns and the macroeconomic factors whose dynamics affect the asset risk can forecast an asset's returns. In other words, the result of this study supports the proposition that the dynamics in the exchange rate, inflation, money supply, and unemployment rate influence the capital market performance. The study validates the recommendations of Arbitrage Pricing Theory (APT) in Nigeria.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBusiness-cycles and Cash-on-Market: Pre-money Startup Valuation in the Macroeconomic Environment

Max Berre, Benjamin Le Pendeven

| Title | Authors | Year | Actions |

|---|

Comments (0)