Authors

Summary

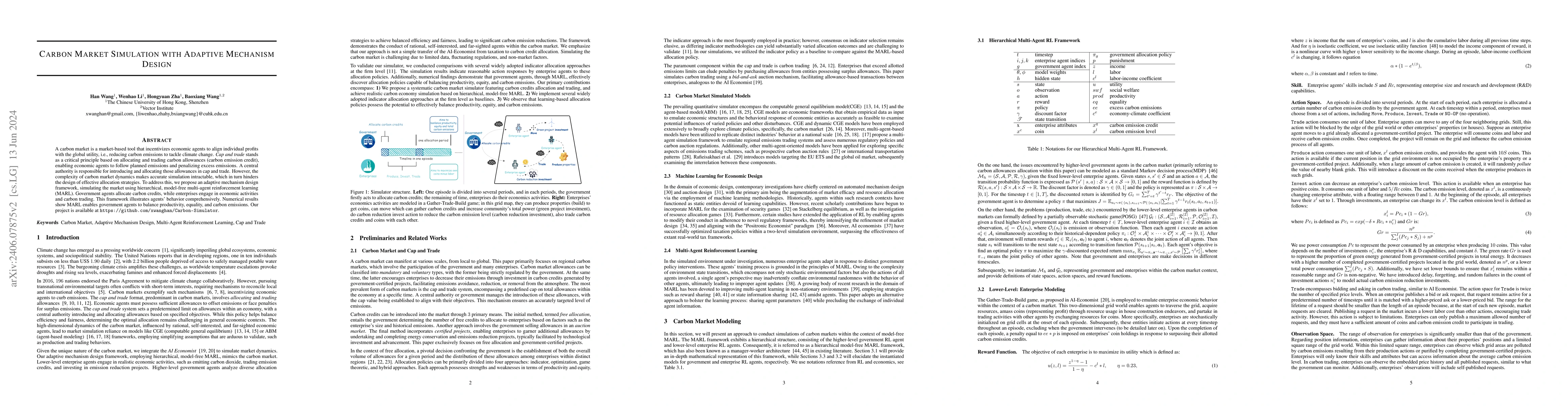

A carbon market is a market-based tool that incentivizes economic agents to align individual profits with the global utility, i.e., reducing carbon emissions to tackle climate change. Cap and trade stands as a critical principle based on allocating and trading carbon allowances (carbon emission credit), enabling economic agents to follow planned emissions and penalizing excess emissions. A central authority is responsible for introducing and allocating those allowances in cap and trade. However, the complexity of carbon market dynamics makes accurate simulation intractable, which in turn hinders the design of effective allocation strategies. To address this, we propose an adaptive mechanism design framework, simulating the market using hierarchical, model-free multi-agent reinforcement learning (MARL). Government agents allocate carbon credits, while enterprises engage in economic activities and carbon trading. This framework illustrates agents' behavior comprehensively. Numerical results show MARL enables government agents to balance productivity, equality, and carbon emissions. Our project is available at https://github.com/xwanghan/Carbon-Simulator.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMechanism Design for Automated Market Makers

T-H. Hubert Chan, Elaine Shi, Ke Wu

Latent Space Simulation for Carbon Capture Design Optimization

Rui Wang, Yucheng Fu, Zhijie Xu et al.

A Multiple Market Trading Mechanism for Electricity, Renewable Energy Certificate and Carbon Emission Right of Virtual Power Plants

Hongbin Sun, Qiuwei Wu, Li Xiao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)