Authors

Summary

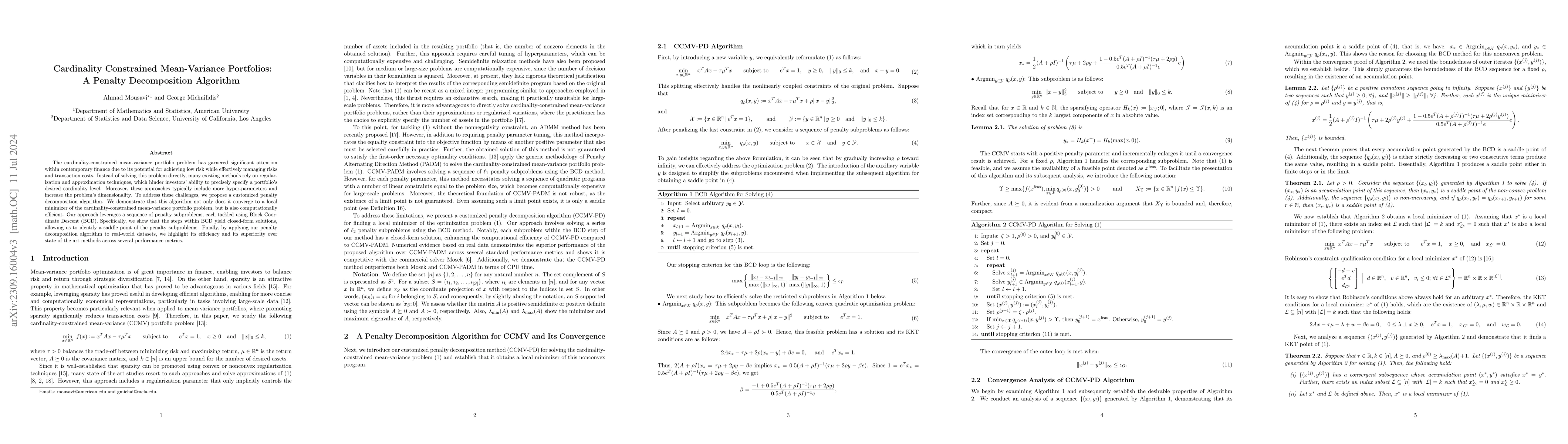

The cardinality-constrained mean-variance portfolio problem has garnered significant attention within contemporary finance due to its potential for achieving low risk while effectively managing risks and transaction costs. Instead of solving this problem directly, many existing methodologies rely on regularization and approximation techniques, which hinder investors' ability to precisely specify the desired cardinality level of a portfolio. Moreover, these approaches typically include more hyper-parameters and increase problem dimensions. In response to these challenges, we demonstrate that a customized penalty decomposition algorithm is perfectly capable of tackling the original problem directly. This algorithm is not only convergent to a local minimizer but also is computationally cheap. It leverages a sequence of penalty subproblems where each of them is tackled via a block coordinate descent approach. In particular, the steps within the latter algorithm yield closed-form solutions and enable the identification of a saddle point of the penalty subproblem. Finally, through the application of our penalty decomposition algorithm to real-world datasets, we showcase its efficiency and its ability to outperform state-of-the-art methods in terms of CPU time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSparse Extended Mean-Variance-CVaR Portfolios with Short-selling

Ahmad Mousavi, Maziar Salahi, Zois Boukouvalas

| Title | Authors | Year | Actions |

|---|

Comments (0)