Authors

Summary

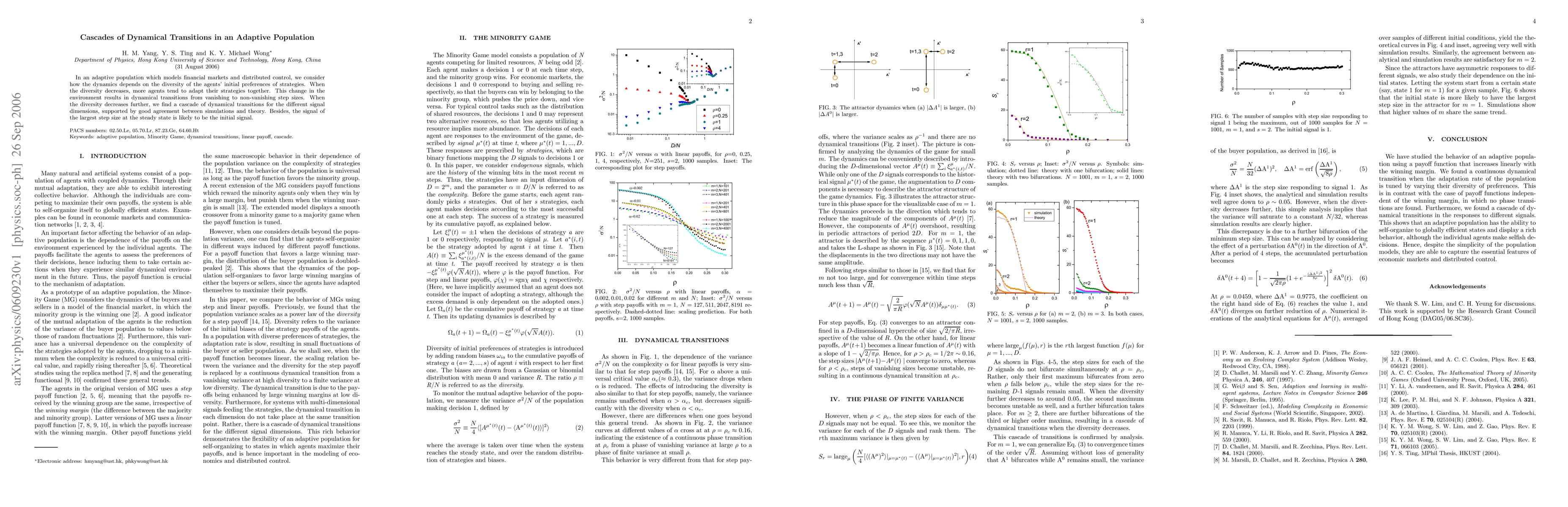

In an adaptive population which models financial markets and distributed control, we consider how the dynamics depends on the diversity of the agents' initial preferences of strategies. When the diversity decreases, more agents tend to adapt their strategies together. This change in the environment results in dynamical transitions from vanishing to non-vanishing step sizes. When the diversity decreases further, we find a cascade of dynamical transitions for the different signal dimensions, supported by good agreement between simulations and theory. Besides, the signal of the largest step size at the steady state is likely to be the initial signal.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)