Summary

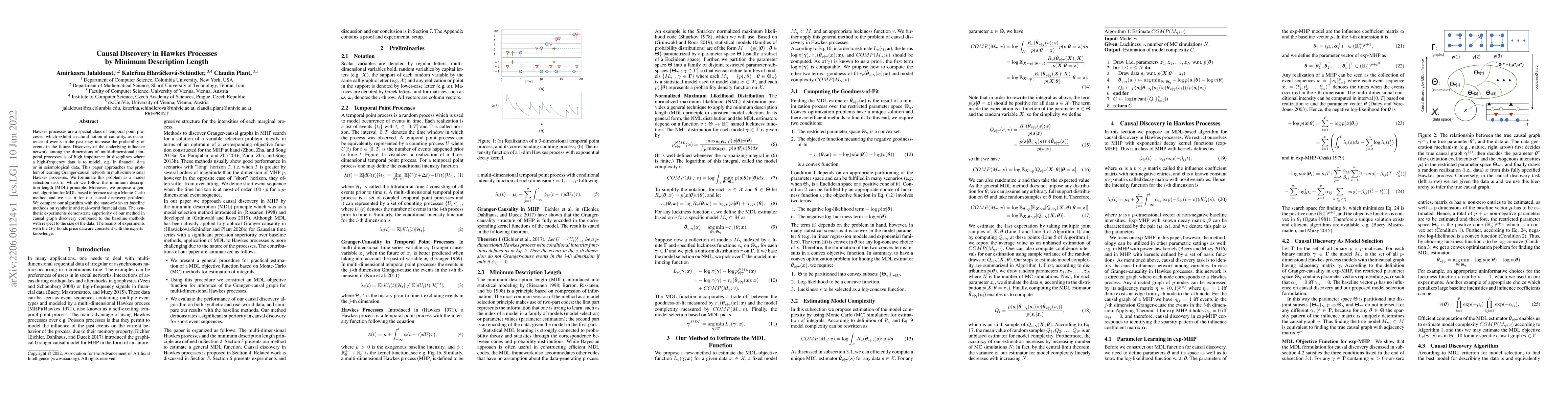

Hawkes processes are a special class of temporal point processes which exhibit a natural notion of causality, as occurrence of events in the past may increase the probability of events in the future. Discovery of the underlying influence network among the dimensions of multi-dimensional temporal processes is of high importance in disciplines where a high-frequency data is to model, e.g. in financial data or in seismological data. This paper approaches the problem of learning Granger-causal network in multi-dimensional Hawkes processes. We formulate this problem as a model selection task in which we follow the minimum description length (MDL) principle. Moreover, we propose a general algorithm for MDL-based inference using a Monte-Carlo method and we use it for our causal discovery problem. We compare our algorithm with the state-of-the-art baseline methods on synthetic and real-world financial data. The synthetic experiments demonstrate superiority of our method incausal graph discovery compared to the baseline methods with respect to the size of the data. The results of experiments with the G-7 bonds price data are consistent with the experts knowledge.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGranger Causal Inference in Multivariate Hawkes Processes by Minimum Message Length

Irene Tubikanec, Katerina Hlavackova-Schindler, Anna Melnykova

THP: Topological Hawkes Processes for Learning Causal Structure on Event Sequences

Xi Zhang, Ruichu Cai, Zhifeng Hao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)