Summary

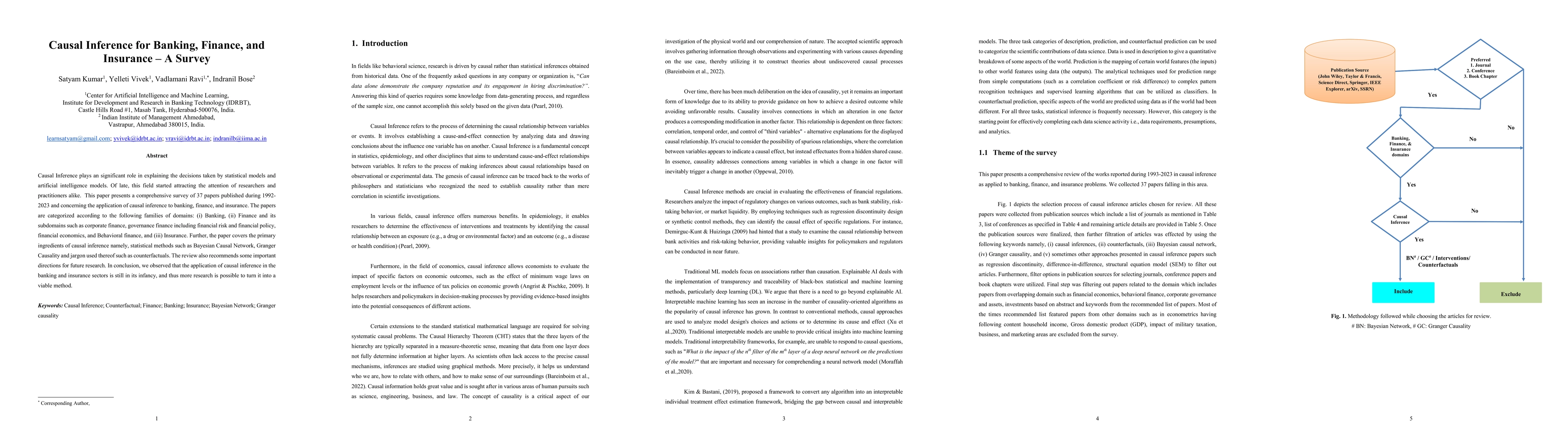

Causal Inference plays an significant role in explaining the decisions taken by statistical models and artificial intelligence models. Of late, this field started attracting the attention of researchers and practitioners alike. This paper presents a comprehensive survey of 37 papers published during 1992-2023 and concerning the application of causal inference to banking, finance, and insurance. The papers are categorized according to the following families of domains: (i) Banking, (ii) Finance and its subdomains such as corporate finance, governance finance including financial risk and financial policy, financial economics, and Behavioral finance, and (iii) Insurance. Further, the paper covers the primary ingredients of causal inference namely, statistical methods such as Bayesian Causal Network, Granger Causality and jargon used thereof such as counterfactuals. The review also recommends some important directions for future research. In conclusion, we observed that the application of causal inference in the banking and insurance sectors is still in its infancy, and thus more research is possible to turn it into a viable method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApplication of Causal Inference to Analytical Customer Relationship Management in Banking and Insurance

Vadlamani Ravi, Satyam Kumar

Insurance-Finance Arbitrage

Thorsten Schmidt, Philippe Artzner, Karl-Theodor Eisele

Robust asymptotic insurance-finance arbitrage

Katharina Oberpriller, Thorsten Schmidt, Moritz Ritter

| Title | Authors | Year | Actions |

|---|

Comments (0)