Authors

Summary

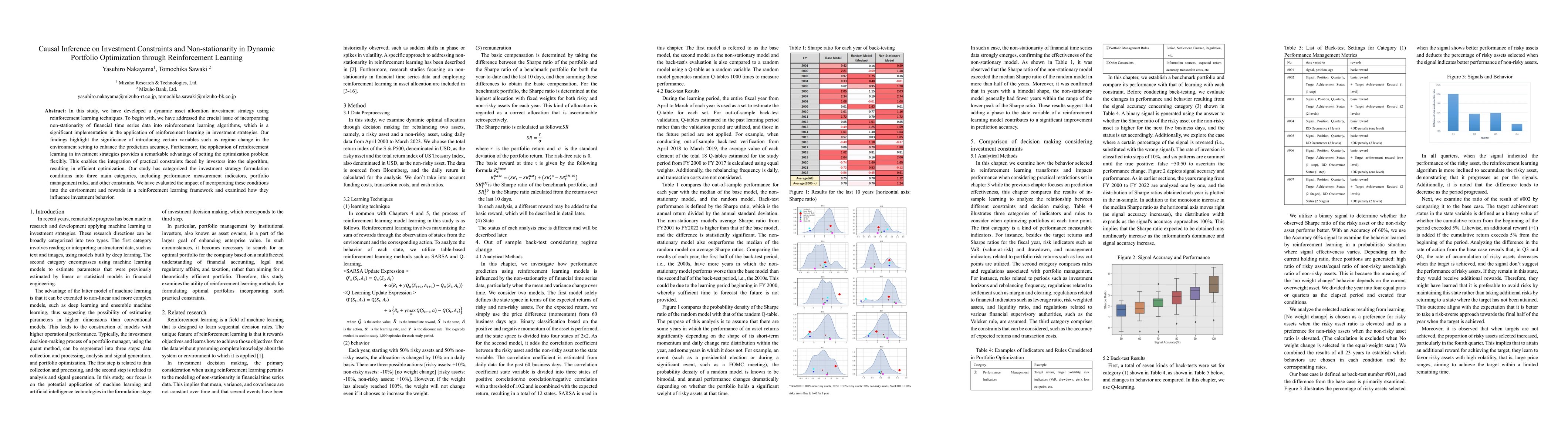

In this study, we have developed a dynamic asset allocation investment strategy using reinforcement learning techniques. To begin with, we have addressed the crucial issue of incorporating non-stationarity of financial time series data into reinforcement learning algorithms, which is a significant implementation in the application of reinforcement learning in investment strategies. Our findings highlight the significance of introducing certain variables such as regime change in the environment setting to enhance the prediction accuracy. Furthermore, the application of reinforcement learning in investment strategies provides a remarkable advantage of setting the optimization problem flexibly. This enables the integration of practical constraints faced by investors into the algorithm, resulting in efficient optimization. Our study has categorized the investment strategy formulation conditions into three main categories, including performance measurement indicators, portfolio management rules, and other constraints. We have evaluated the impact of incorporating these conditions into the environment and rewards in a reinforcement learning framework and examined how they influence investment behavior.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTackling Non-Stationarity in Reinforcement Learning via Causal-Origin Representation

Zongqing Lu, Yilin Li, Boyu Yang et al.

Dynamic Optimization of Portfolio Allocation Using Deep Reinforcement Learning

Gang Huang, Qingyang Song, Xiaohua Zhou

Attention-Enhanced Reinforcement Learning for Dynamic Portfolio Optimization

Pei Xue, Yuanchun Ye

Continuous-time optimal investment with portfolio constraints: a reinforcement learning approach

Duy Nguyen, Thai Nguyen, Huy Chau

No citations found for this paper.

Comments (0)