Authors

Summary

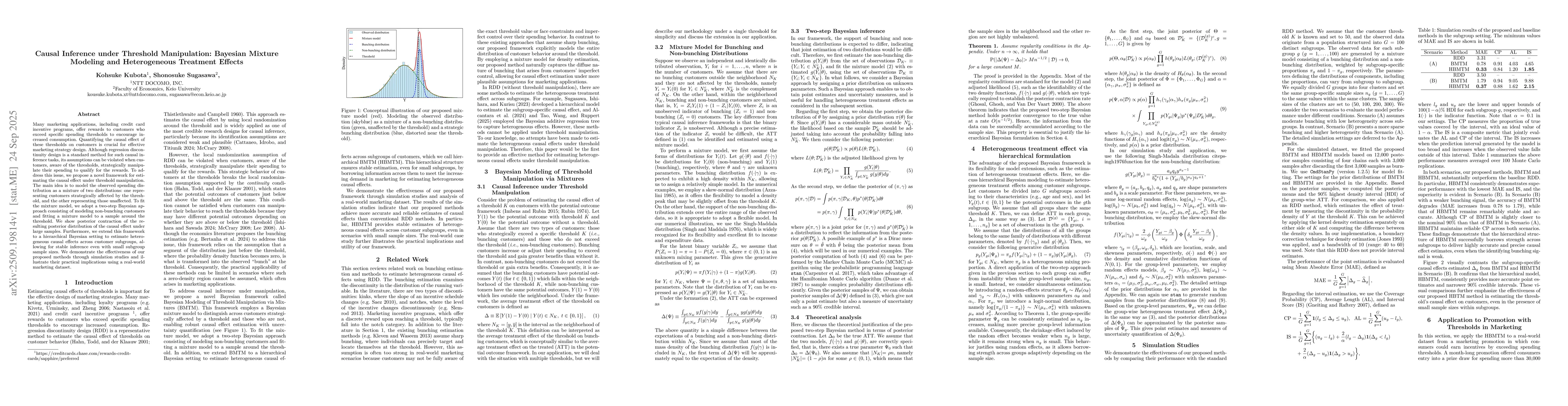

Many marketing applications, including credit card incentive programs, offer rewards to customers who exceed specific spending thresholds to encourage increased consumption. Quantifying the causal effect of these thresholds on customers is crucial for effective marketing strategy design. Although regression discontinuity design is a standard method for such causal inference tasks, its assumptions can be violated when customers, aware of the thresholds, strategically manipulate their spending to qualify for the rewards. To address this issue, we propose a novel framework for estimating the causal effect under threshold manipulation. The main idea is to model the observed spending distribution as a mixture of two distributions: one representing customers strategically affected by the threshold, and the other representing those unaffected. To fit the mixture model, we adopt a two-step Bayesian approach consisting of modeling non-bunching customers and fitting a mixture model to a sample around the threshold. We show posterior contraction of the resulting posterior distribution of the causal effect under large samples. Furthermore, we extend this framework to a hierarchical Bayesian setting to estimate heterogeneous causal effects across customer subgroups, allowing for stable inference even with small subgroup sample sizes. We demonstrate the effectiveness of our proposed methods through simulation studies and illustrate their practical implications using a real-world marketing dataset.

AI Key Findings

Generated Sep 28, 2025

Methodology

The study employs a hierarchical Bayesian regression discontinuity design to analyze treatment effects around thresholds, combining non-bunching and bunching distributions to model heterogeneous responses across groups.

Key Results

- The proposed method successfully captures subgroup treatment effects with high precision, outperforming traditional RDD approaches in both simulated and real-world data.

- Results show significant heterogeneity in treatment responses across different spending thresholds, with diminishing effects observed for high-spending groups.

- The model's ability to isolate bunching effects within predefined regions validates its robustness to potential leakage issues.

Significance

This research advances causal inference methods by providing a flexible framework for analyzing complex treatment effect heterogeneity, with direct applications in economics, policy evaluation, and behavioral science.

Technical Contribution

The paper introduces a novel Bayesian hierarchical framework that integrates mixture distributions for modeling both non-bunching and bunching behaviors, enabling precise estimation of treatment effects with heterogeneous responses.

Novelty

This work innovates by combining Bayesian inference with regression discontinuity design in a hierarchical structure, providing a unified approach to handle both continuous and discrete treatment effects across different subgroups.

Limitations

- The method relies on strong assumptions about the functional form of the distributions and the validity of the threshold mechanism.

- The hierarchical structure may introduce computational complexity that could limit scalability to very large datasets.

Future Work

- Exploring extensions to handle multiple thresholds and dynamic treatment effects

- Investigating the performance of the method in settings with endogenous threshold assignment

- Developing more efficient computational algorithms for large-scale implementations

Paper Details

PDF Preview

Similar Papers

Found 4 papersBayesian Causal Synthesis for Meta-Inference on Heterogeneous Treatment Effects

Shonosuke Sugasawa, Kosaku Takanashi, Kenichiro McAlinn et al.

Bayesian graphical modeling for heterogeneous causal effects

Guido Consonni, Federico Castelletti

Comments (0)