Summary

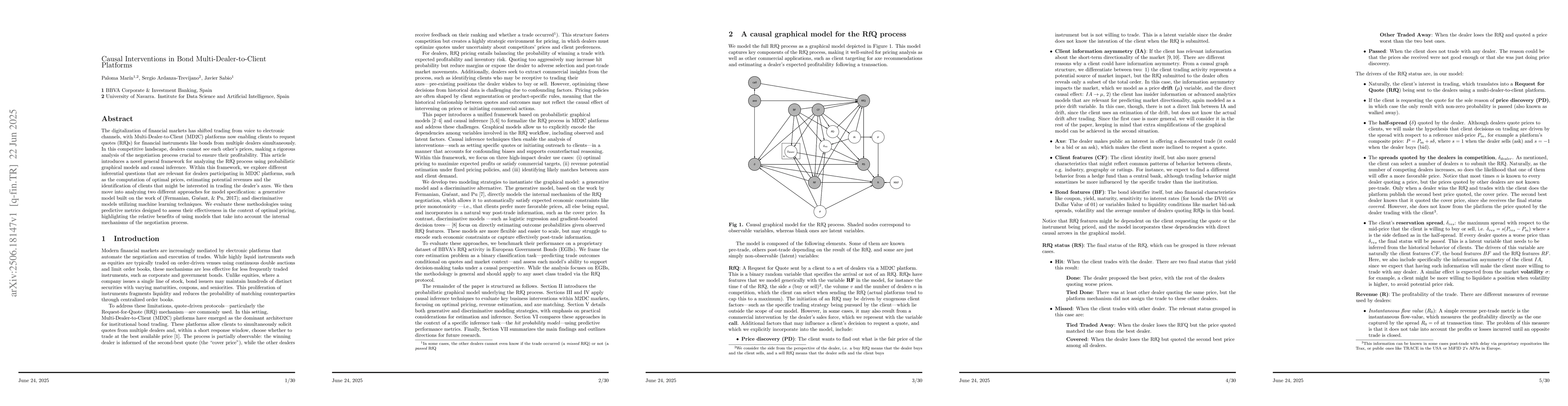

The digitalization of financial markets has shifted trading from voice to electronic channels, with Multi-Dealer-to-Client (MD2C) platforms now enabling clients to request quotes (RfQs) for financial instruments like bonds from multiple dealers simultaneously. In this competitive landscape, dealers cannot see each other's prices, making a rigorous analysis of the negotiation process crucial to ensure their profitability. This article introduces a novel general framework for analyzing the RfQ process using probabilistic graphical models and causal inference. Within this framework, we explore different inferential questions that are relevant for dealers participating in MD2C platforms, such as the computation of optimal prices, estimating potential revenues and the identification of clients that might be interested in trading the dealer's axes. We then move into analyzing two different approaches for model specification: a generative model built on the work of (Fermanian, Gu\'eant & Pu, 2017); and discriminative models utilizing machine learning techniques. We evaluate these methodologies using predictive metrics designed to assess their effectiveness in the context of optimal pricing, highlighting the relative benefits of using models that take into account the internal mechanisms of the negotiation process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCharacterising Interventions in Causal Games

Michael Wooldridge, Manuj Mishra, James Fox

Identifying Linearly-Mixed Causal Representations from Multi-Node Interventions

Jonas Wahl, Jakob Runge, Simon Bing et al.

Linear Causal Representation Learning from Unknown Multi-node Interventions

Burak Varıcı, Ali Tajer, Emre Acartürk et al.

No citations found for this paper.

Comments (0)