Summary

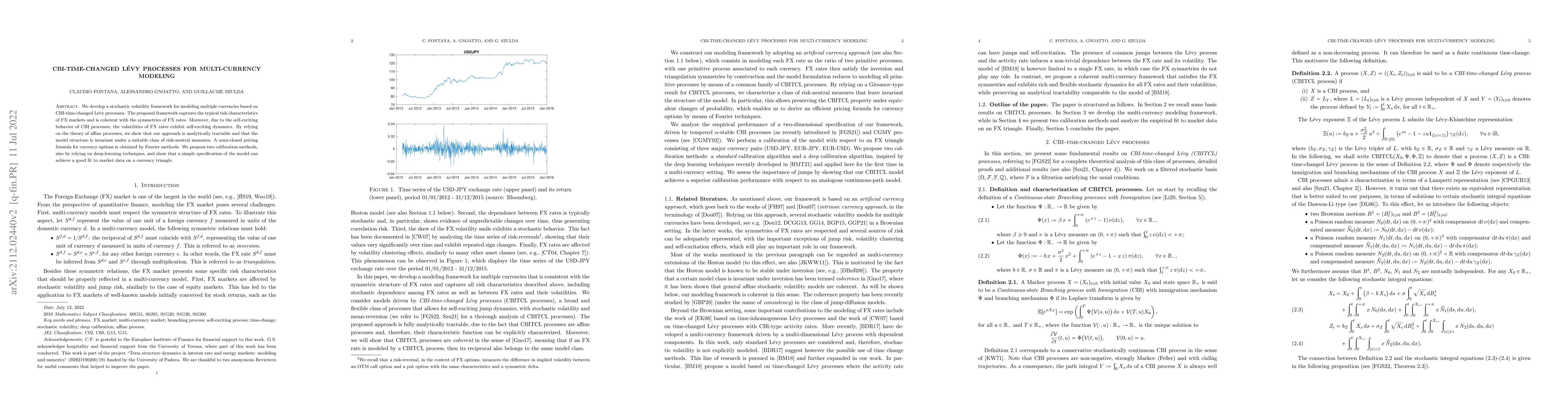

We develop a stochastic volatility framework for modeling multiple currencies based on CBI-time-changed L\'evy processes. The proposed framework captures the typical risk characteristics of FX markets and is coherent with the symmetries of FX rates. Moreover, due to the self-exciting behavior of CBI processes, the volatilities of FX rates exhibit self-exciting dynamics. By relying on the theory of affine processes, we show that our approach is analytically tractable and that the model structure is invariant under a suitable class of risk-neutral measures. A semi-closed pricing formula for currency options is obtained by Fourier methods. We propose two calibration methods, also by relying on deep-learning techniques, and show that a simple specification of the model can achieve a good fit to market data on a currency triangle.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)