Summary

The introduction of CCPs in most derivative transactions will dramatically change the landscape of derivatives pricing, hedging and risk management, and, according to the TABB group, will lead to an overall liquidity impact about 2 USD trillions. In this article we develop for the first time a comprehensive approach for pricing under CCP clearing, including variation and initial margins, gap credit risk and collateralization, showing concrete examples for interest rate swaps. Mathematically, the inclusion of asymmetric borrowing and lending rates in the hedge of a claim lead to nonlinearities showing up in claim dependent pricing measures, aggregation dependent prices, nonlinear PDEs and BSDEs. This still holds in presence of CCPs and CSA. We introduce a modeling approach that allows us to enforce rigorous separation of the interconnected nonlinear risks into different valuation adjustments where the key pricing nonlinearities are confined to a funding costs component that is analyzed through numerical schemes for BSDEs. We present a numerical case study for Interest Rate Swaps that highlights the relative size of the different valuation adjustments and the quantitative role of initial and variation margins, of liquidity bases, of credit risk, of the margin period of risk and of wrong way risk correlations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

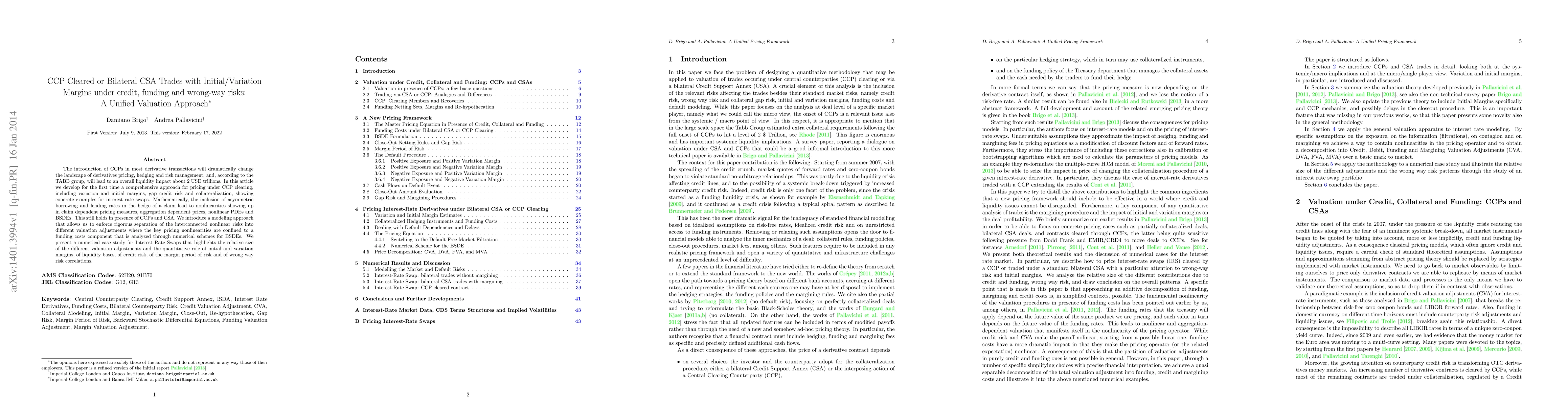

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)