Summary

Basel III introduces new capital charges for CVA. These charges, and the Basel 2.5 default capital charge can be mitigated by CDS. Therefore, to price in the capital relief that CDS contracts provide, we introduce a CDS pricing model with three legs: premium; default protection; and capital relief. If markets are complete, with no CDS bond basis, then CDSs can be replicated by taking short positions in risky floating bonds issued by the reference entity and a riskless bank account. If these conditions do not hold, then it is theoretically possible that the capital relief that CDSs provide may be priced in. Thus our model provides bounds on the CDS-implied hazard rates when markets are incomplete. Under simple assumptions we show that 20% to over 50% of observed CDS spread could be due to priced in capital relief. Given that this is different for IMM and non-IMM banks will we see differential pricing?

AI Key Findings

Generated Sep 04, 2025

Methodology

A CDS model that adds capital relief was developed to address the requirements of pricing default probabilities and capital relief.

Key Results

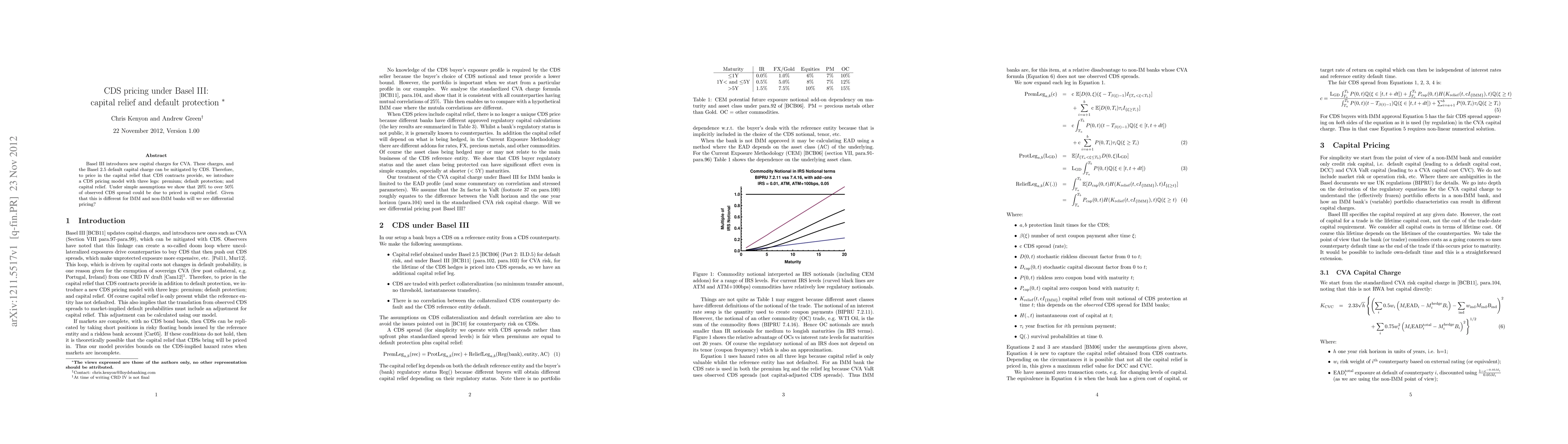

- The new model includes a premium component, protection component, and capital relief component.

- Capital relief pricing has a potentially significant impact on CDS spreads, with effects ranging from 20% to 50%.

- Both the IMM status of the CDS buyer and the asset class that the CDS buyer is obtaining capital relief on have major effects, especially for short-term maturities.

Significance

The research highlights the importance of considering capital relief in CDS pricing and its potential impact on market prices.

Technical Contribution

The new model provides a framework for pricing default probabilities and capital relief in CDS contracts.

Novelty

The model's use of a three-legged approach (premium, protection, and capital relief) is novel and different from existing research

Limitations

- The model assumes counterparty default is independent of interest rates.

- The model does not explicitly account for IMM-bank stress testing

- The model uses a simplified approach to calculate effective EE

Future Work

- Further research is needed on the impact of VaR horizon and multipliers on CVA capital calculations

- Development of more sophisticated models that incorporate funding costs and other factors

- Investigating the potential for sovereign trades to be exempt from CVA capital charges

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)