Summary

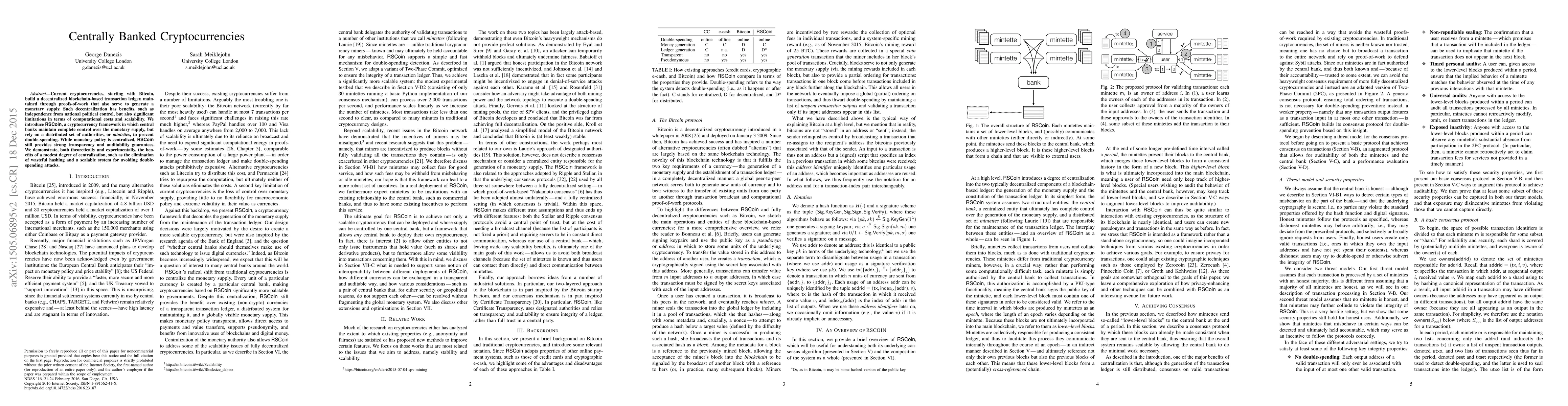

Current cryptocurrencies, starting with Bitcoin, build a decentralized blockchain-based transaction ledger, maintained through proofs-of-work that also generate a monetary supply. Such decentralization has benefits, such as independence from national political control, but also significant limitations in terms of scalability and computational cost. We introduce RSCoin, a cryptocurrency framework in which central banks maintain complete control over the monetary supply, but rely on a distributed set of authorities, or mintettes, to prevent double-spending. While monetary policy is centralized, RSCoin still provides strong transparency and auditability guarantees. We demonstrate, both theoretically and experimentally, the benefits of a modest degree of centralization, such as the elimination of wasteful hashing and a scalable system for avoiding double-spending attacks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBanked Memories for Soft SIMT Processors

George A. Constantinides, Martin Langhammer

| Title | Authors | Year | Actions |

|---|

Comments (0)