Summary

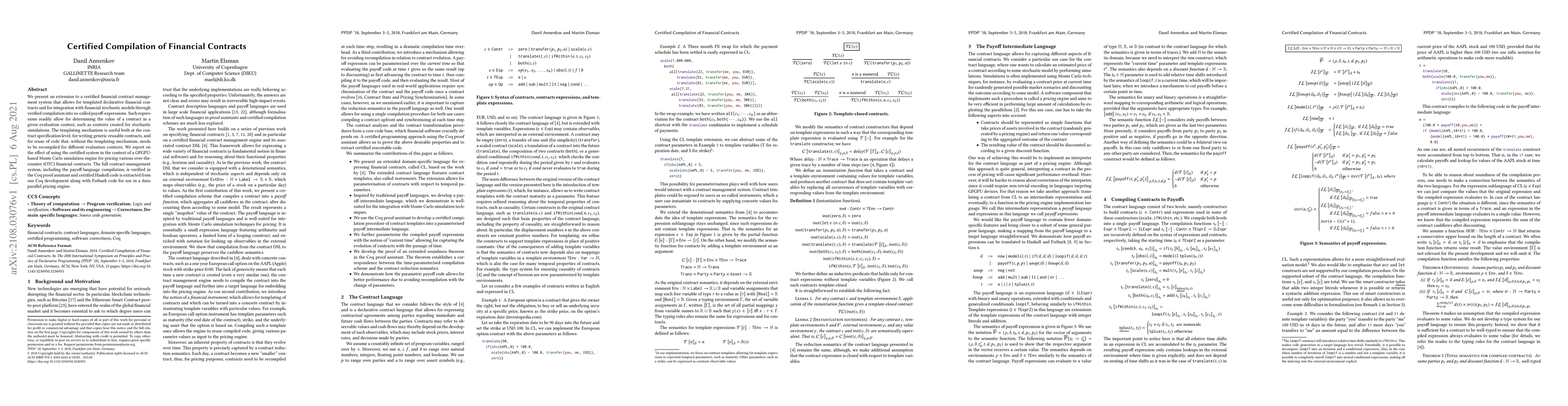

We present an extension to a certified financial contract management system that allows for templated declarative financial contracts and for integration with financial stochastic models through verified compilation into so-called payoff-expressions. Such expressions readily allow for determining the value of a contract in a given evaluation context, such as contexts created for stochastic simulations. The templating mechanism is useful both at the contract specification level, for writing generic reusable contracts, and for reuse of code that, without the templating mechanism, needs to be recompiled for different evaluation contexts. We report on the effect of using the certified system in the context of a GPGPU-based Monte Carlo simulation engine for pricing various over-the-counter (OTC) financial contracts. The full contract-management system, including the payoff-language compilation, is verified in the Coq proof assistant and certified Haskell code is extracted from our Coq development along with Futhark code for use in a data-parallel pricing engine.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFoundational Verification of Smart Contracts through Verified Compilation

Vilhelm Sjöberg, Kinnari Dave, Daniel Britten et al.

Secure compilation of rich smart contracts on poor UTXO blockchains

Massimo Bartoletti, Riccardo Marchesin, Roberto Zunino

An Automated Analyzer for Financial Security of Ethereum Smart Contracts

Zhaoyi Meng, Wansen Wang, Wenchao Huang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)