Summary

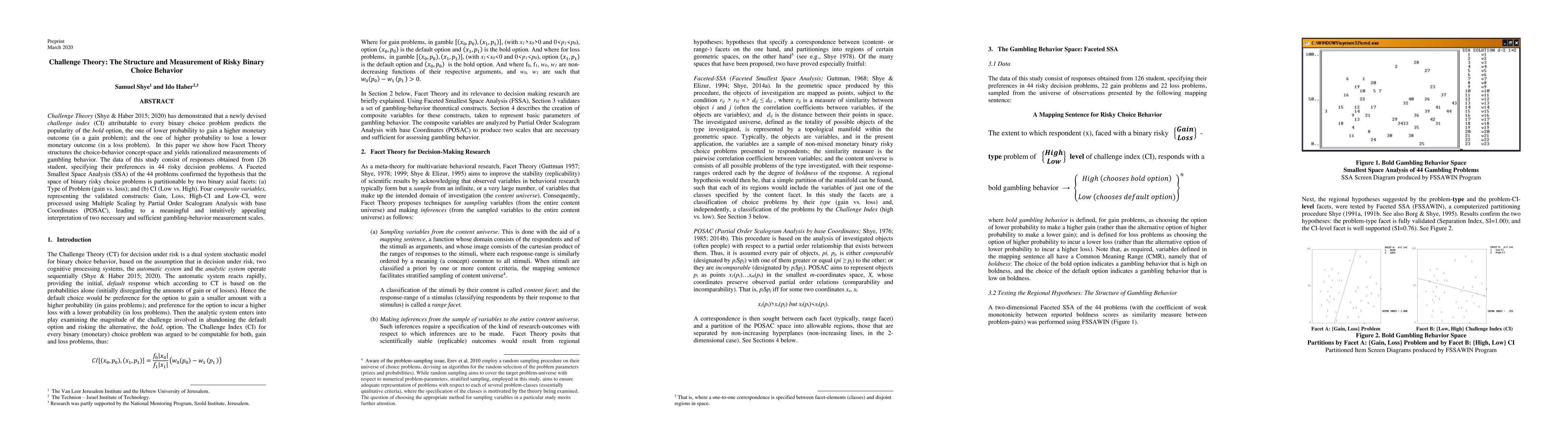

Challenge Theory (Shye & Haber 2015; 2020) has demonstrated that a newly devised challenge index (CI) attributable to every binary choice problem predicts the popularity of the bold option, the one of lower probability to gain a higher monetary outcome (in a gain problem); and the one of higher probability to lose a lower monetary outcome (in a loss problem). In this paper we show how Facet Theory structures the choice-behavior concept-space and yields rationalized measurements of gambling behavior. The data of this study consist of responses obtained from 126 student, specifying their preferences in 44 risky decision problems. A Faceted Smallest Space Analysis (SSA) of the 44 problems confirmed the hypothesis that the space of binary risky choice problems is partitionable by two binary axial facets: (a) Type of Problem (gain vs. loss); and (b) CI (Low vs. High). Four composite variables, representing the validated constructs: Gain, Loss, High-CI and Low-CI, were processed using Multiple Scaling by Partial Order Scalogram Analysis with base Coordinates (POSAC), leading to a meaningful and intuitively appealing interpretation of two necessary and sufficient gambling-behavior measurement scales.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)