Summary

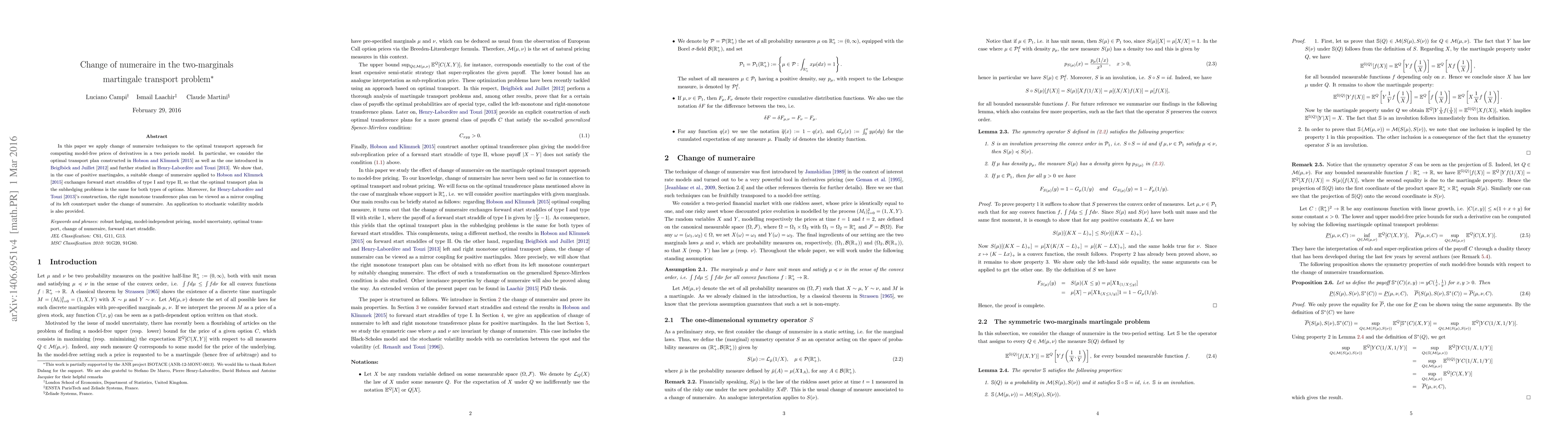

In this paper we apply change of numeraire techniques to the optimal transport approach for computing model-free prices of derivatives in a two periods model. In particular, we consider the optimal transport plan constructed in \cite{HobsonKlimmek2013} as well as the one introduced in \cite{BeiglJuil} and further studied in \cite{BrenierMartingale}. We show that, in the case of positive martingales, a suitable change of numeraire applied to \cite{HobsonKlimmek2013} exchanges forward start straddles of type I and type II, so that the optimal transport plan in the subhedging problems is the same for both types of options. Moreover, for \cite{BrenierMartingale}'s construction, the right monotone transference plan can be viewed as a mirror coupling of its left counterpart under the change of numeraire. An application to stochastic volatility models is also provided.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersChange of numeraire for weak martingale transport

Mathias Beiglböck, Gudmund Pammer, Lorenz Riess

Stability of the Weak Martingale Optimal Transport Problem

Mathias Beiglböck, Benjamin Jourdain, Gudmund Pammer et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)