Authors

Summary

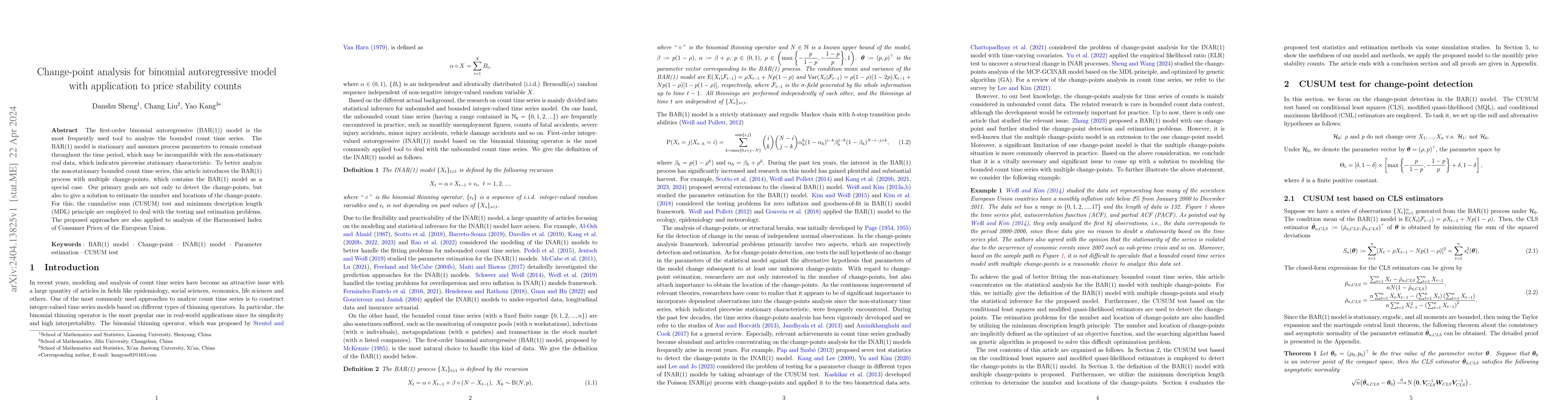

The first-order binomial autoregressive (BAR(1)) model is the most frequently used tool to analyze the bounded count time series. The BAR(1) model is stationary and assumes process parameters to remain constant throughout the time period, which may be incompatible with the non-stationary real data, which indicates piecewise stationary characteristic. To better analyze the non-stationary bounded count time series, this article introduces the BAR(1) process with multiple change-points, which contains the BAR(1) model as a special case. Our primary goals are not only to detect the change-points, but also to give a solution to estimate the number and locations of the change-points. For this, the cumulative sum (CUSUM) test and minimum description length (MDL) principle are employed to deal with the testing and estimation problems. The proposed approaches are also applied to analysis of the Harmonised Index of Consumer Prices of the European Union.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSequential Change-point Detection for Binomial Time Series with Exogenous Variables

Yajun Liu, Beth Andrews

Inference on Dynamic Spatial Autoregressive Models with Change Point Detection

Yudong Chen, Clifford Lam, Zetai Cen

| Title | Authors | Year | Actions |

|---|

Comments (0)