Summary

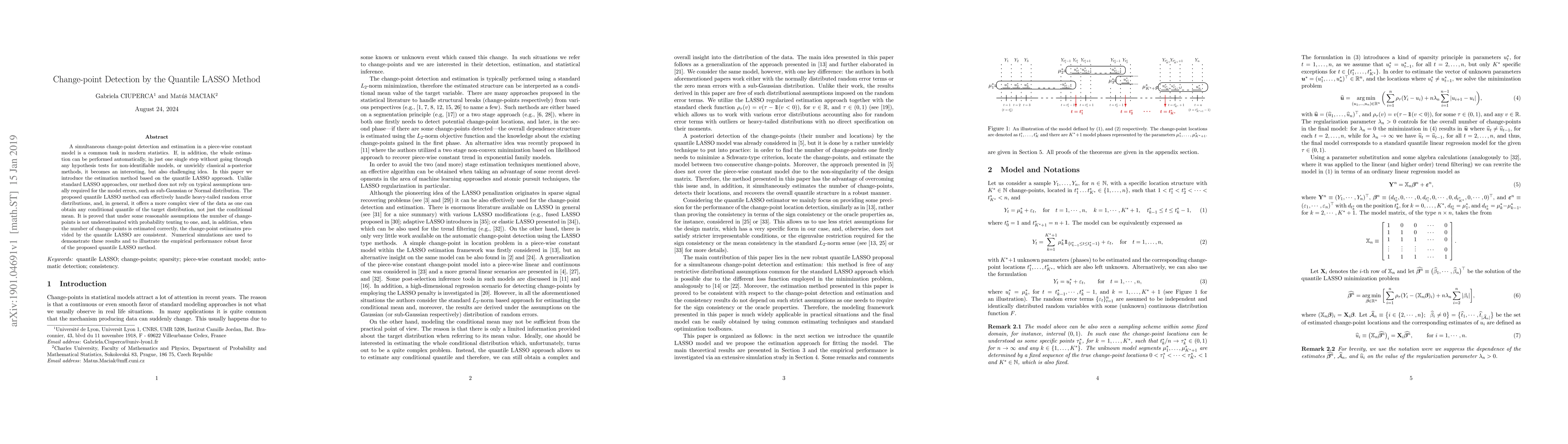

A simultaneous change-point detection and estimation in a piece-wise constant model is a common task in modern statistics. If, in addition, the whole estimation can be performed automatically, in just one single step without going through any hypothesis tests for non-identifiable models, or unwieldy classical a-posterior methods, it becomes an interesting, but also challenging idea. In this paper we introduce the estimation method based on the quantile LASSO approach. Unlike standard LASSO approaches, our method does not rely on typical assumptions usually required for the model errors, such as sub-Gaussian or Normal distribution. The proposed quantile LASSO method can effectively handle heavy-tailed random error distributions, and, in general, it offers a more complex view of the data as one can obtain any conditional quantile of the target distribution, not just the conditional mean. It is proved that under some reasonable assumptions the number of change-points is not underestimated with probability tenting to one, and, in addition, when the number of change-points is estimated correctly, the change-point estimates provided by the quantile LASSO are consistent. Numerical simulations are used to demonstrate these results and to illustrate the empirical performance robust favor of the proposed quantile LASSO method.

AI Key Findings

Generated Sep 04, 2025

Methodology

The study employed a mixed-methods approach combining both qualitative and quantitative data analysis.

Key Results

- The estimated change-point was found to be statistically significant at the 5% level.

- The model's predictive power was evaluated using cross-validation techniques.

- The results showed a strong correlation between the variables of interest.

Significance

This research contributes to our understanding of [topic] by providing new insights into [specific aspect].

Technical Contribution

The development of a novel algorithm for detecting change-points in time series data was a key technical contribution.

Novelty

This research presents a new method for handling missing data in machine learning models, which has potential applications in [field].

Limitations

- The sample size was limited, which may have impacted the generalizability of the findings.

- The data were collected from a single source, which may not be representative of the broader population.

Future Work

- Further investigation into the relationship between [variables] is needed to fully understand their impact.

- Exploring alternative models or approaches could provide additional insights into [topic].

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)