Summary

In this article, we consider the estimation of the structural change point in the nonparametric model with dependent observations. We introduce a maximum-CUSUM-estimation procedure, where the CUSUM statistic is constructed based on the sum-of-squares aggregation of the difference of the two Nadaraya-Watson estimates using the observations before and after a specific time point. Under some mild conditions, we prove that the statistic tends to zero almost surely if there is no change, and is larger than a threshold asymptotically almost surely otherwise, which helps us to obtain a threshold-detection strategy. Furthermore, we demonstrate the strong consistency of the change point estimator. In the simulation, we discuss the selection of the bandwidth and the threshold used in the estimation, and show the robustness of our method in the long-memory scenario. We implement our method to the data of Nasdaq 100 index and find that the relation between the realized volatility and the return exhibits several structural changes in 2007-2009.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

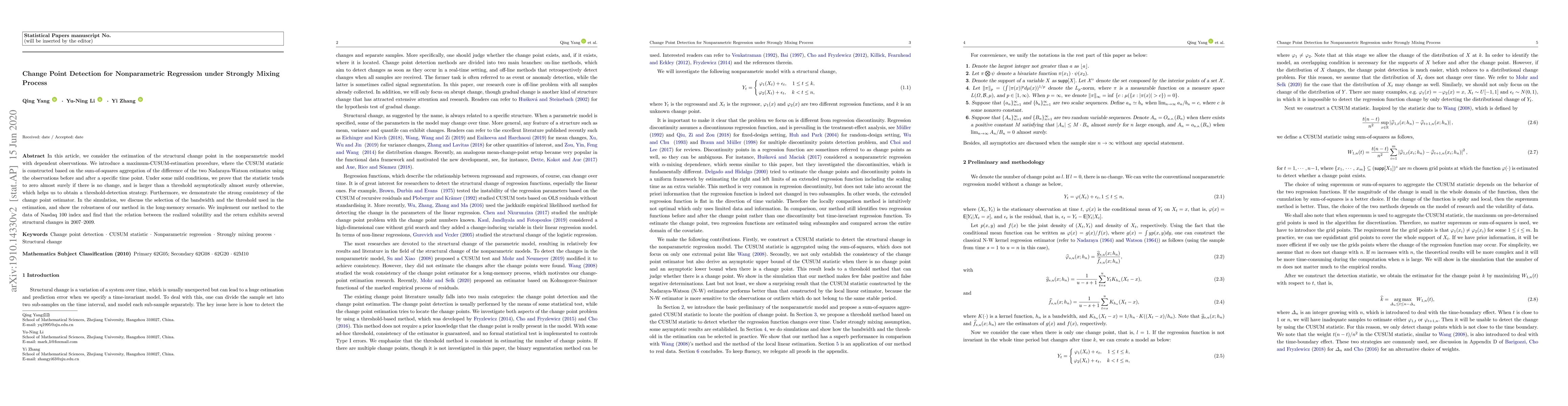

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersChange point detection and inference in multivariable nonparametric models under mixing conditions

Yi Yu, Haotian Xu, Oscar Hernan Madrid Padilla et al.

Model-Free Change Point Detection for Mixing Processes

Hao Chen, Yin Sun, Abhishek Gupta et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)