Summary

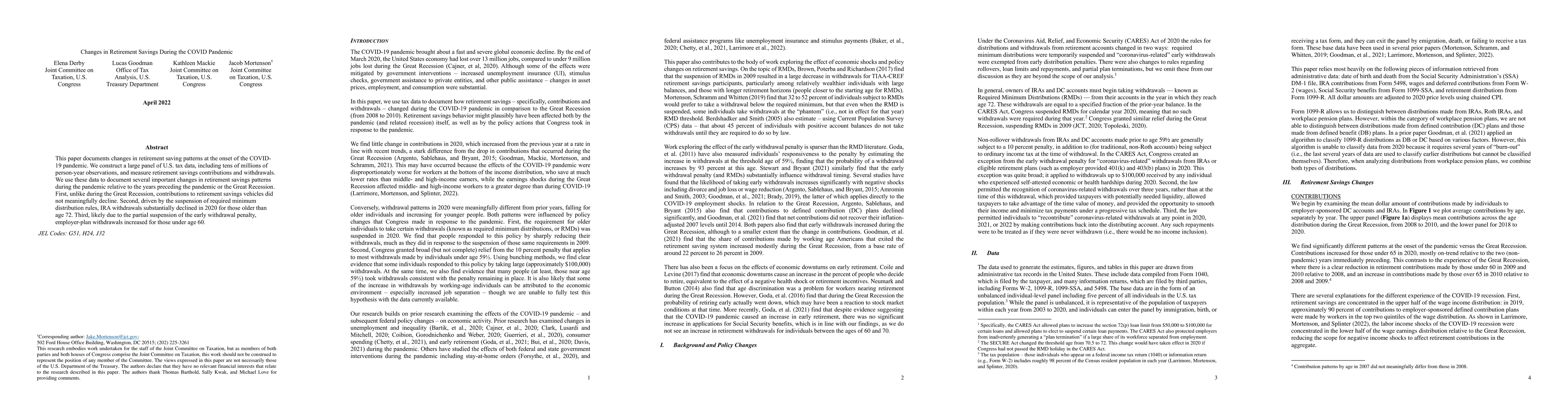

This paper documents changes in retirement saving patterns at the onset of the COVID-19 pandemic. We construct a large panel of U.S. tax data, including tens of millions of person-year observations, and measure retirement savings contributions and withdrawals. We use these data to document several important changes in retirement savings patterns during the pandemic relative to the years preceding the pandemic or the Great Recession. First, unlike during the Great Recession, contributions to retirement savings vehicles did not meaningfully decline. Second, driven by the suspension of required minimum distribution rules, IRA withdrawals substantially declined in 2020 for those older than age 72. Third, potentially driven by partial suspension of the early withdrawal penalty, employer-plan withdrawals increased for those under age 60.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)