Summary

Given a finite honest time, we first show that the associated Az\'ema optional supermartingale can be expressed as the drawdown and the relative drawdown of some local optional supermartingales with continuous running supremum. The relative drawdown representation then allows us to provide a characterisation of finite honest times using a family of non-negative local optional supermartingales with continuous running supremum which converges to zero at infinity. Then we extend the notion of semimartingales of class-$(\Sigma)$ by allowing for jumps in its finite variation part of the semimartingale decomposition. This enables one to establish the Madan-Roynette-Yor option pricing formula for a larger class of processes, and finally, we apply the extended formula to the construction of finite honest times.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

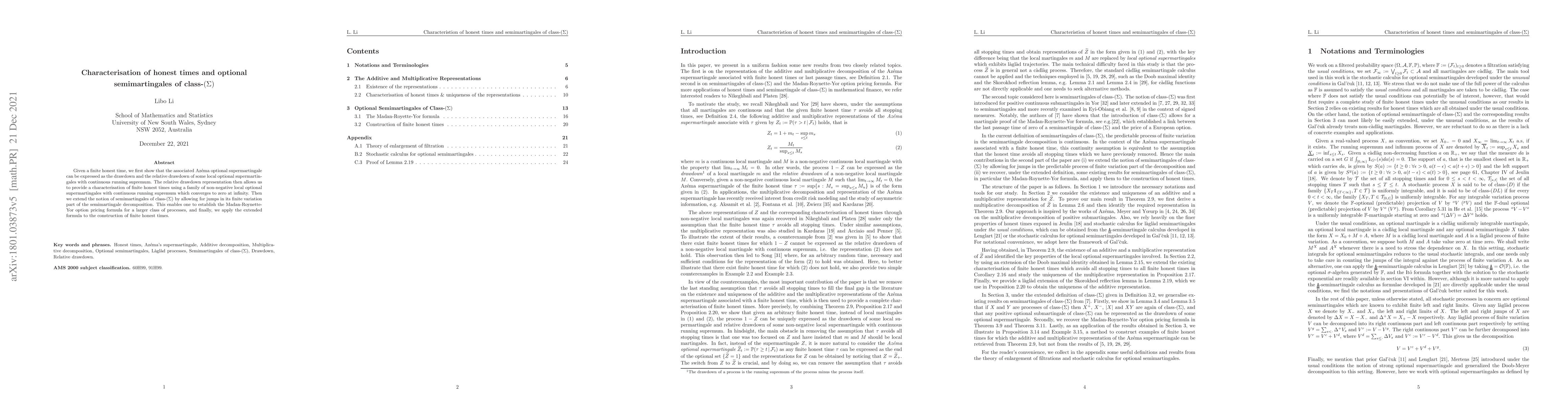

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)