Summary

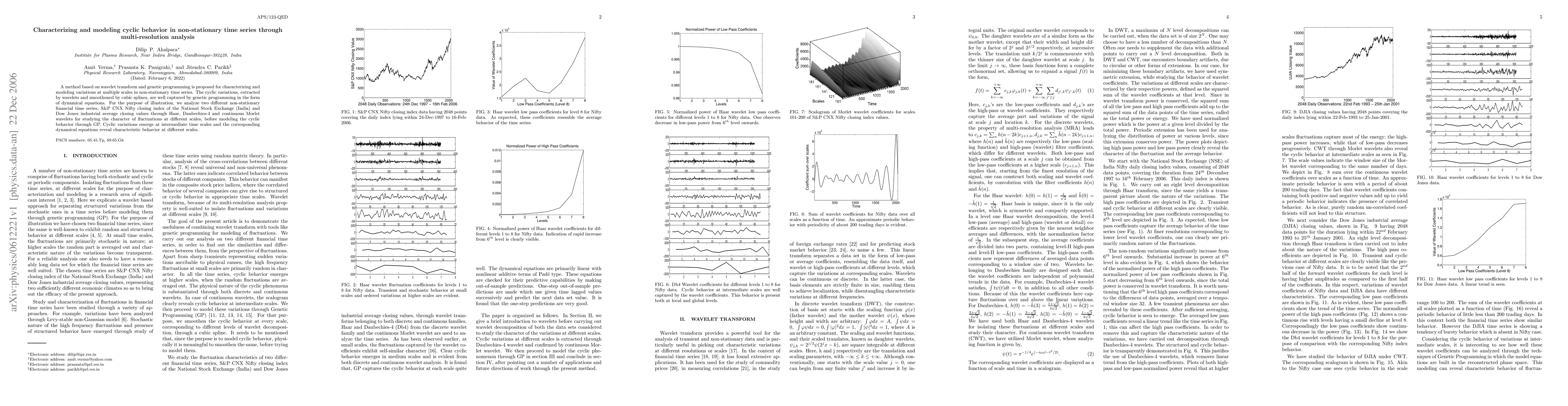

A method based on wavelet transform and genetic programming is proposed for characterizing and modeling variations at multiple scales in non-stationary time series. The cyclic variations, extracted by wavelets and smoothened by cubic splines, are well captured by genetic programming in the form of dynamical equations. For the purpose of illustration, we analyze two different non-stationary financial time series, S&P CNX Nifty closing index of the National Stock Exchange (India) and Dow Jones industrial average closing values through Haar, Daubechies-4 and continuous Morlet wavelets for studying the character of fluctuations at different scales, before modeling the cyclic behavior through GP. Cyclic variations emerge at intermediate time scales and the corresponding dynamical equations reveal characteristic behavior at different scales.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)