Authors

Summary

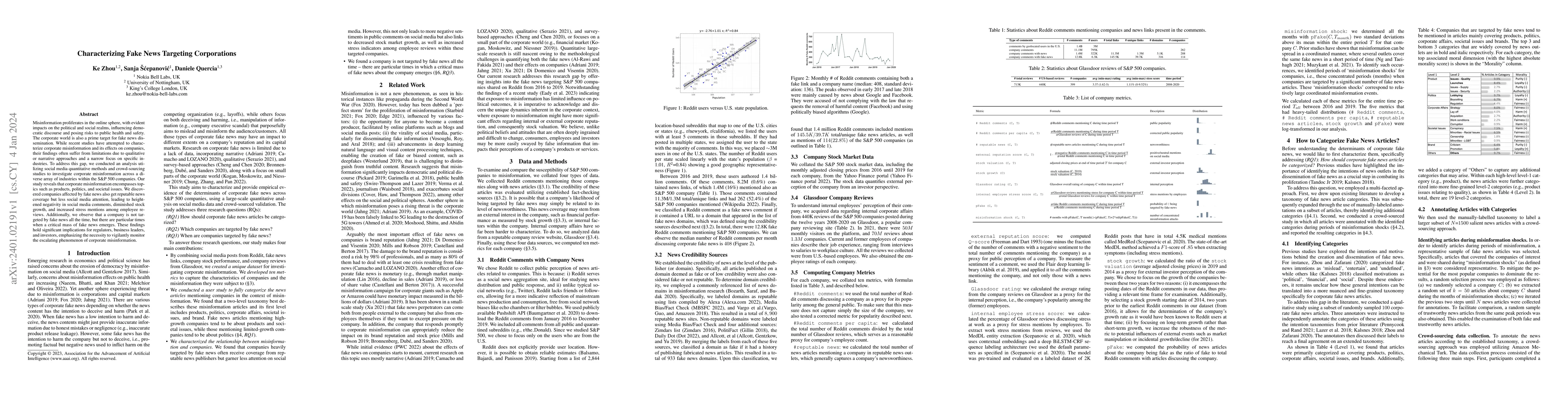

Misinformation proliferates in the online sphere, with evident impacts on the political and social realms, influencing democratic discourse and posing risks to public health and safety. The corporate world is also a prime target for fake news dissemination. While recent studies have attempted to characterize corporate misinformation and its effects on companies, their findings often suffer from limitations due to qualitative or narrative approaches and a narrow focus on specific industries. To address this gap, we conducted an analysis utilizing social media quantitative methods and crowd-sourcing studies to investigate corporate misinformation across a diverse array of industries within the S\&P 500 companies. Our study reveals that corporate misinformation encompasses topics such as products, politics, and societal issues. We discovered companies affected by fake news also get reputable news coverage but less social media attention, leading to heightened negativity in social media comments, diminished stock growth, and increased stress mentions among employee reviews. Additionally, we observe that a company is not targeted by fake news all the time, but there are particular times when a critical mass of fake news emerges. These findings hold significant implications for regulators, business leaders, and investors, emphasizing the necessity to vigilantly monitor the escalating phenomenon of corporate misinformation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnnotation-Scheme Reconstruction for "Fake News" and Japanese Fake News Dataset

Taichi Murayama, Eiji Aramaki, Shohei Hisada et al.

Synthetic News Generation for Fake News Classification

Abdul Sittar, Luka Golob, Mateja Smiljanic

| Title | Authors | Year | Actions |

|---|

Comments (0)