Authors

Summary

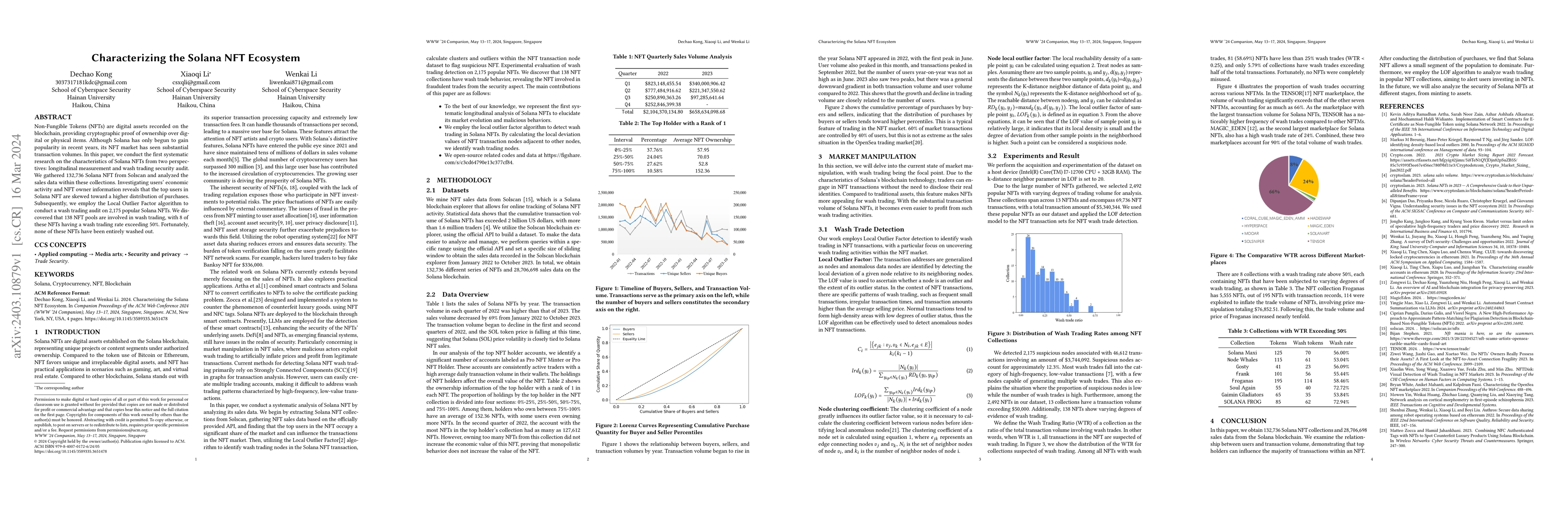

Non-Fungible Tokens (NFTs) are digital assets recorded on the blockchain, providing cryptographic proof of ownership over digital or physical items. Although Solana has only begun to gain popularity in recent years, its NFT market has seen substantial transaction volumes. In this paper, we conduct the first systematic research on the characteristics of Solana NFTs from two perspectives: longitudinal measurement and wash trading security audit. We gathered 132,736 Solana NFT from Solscan and analyzed the sales data within these collections. Investigating users' economic activity and NFT owner information reveals that the top users in Solana NFT are skewed toward a higher distribution of purchases. Subsequently, we employ the Local Outlier Factor algorithm to conduct a wash trading audit on 2,175 popular Solana NFTs. We discovered that 138 NFT pools are involved in wash trading, with 8 of these NFTs having a wash trading rate exceeding 50%. Fortunately, none of these NFTs have been entirely washed out.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhen Blockchain Meets Crawlers: Real-time Market Analytics in Solana NFT Markets

Xiaoqi Li, Zongwei Li, Zhongwen Li et al.

Understanding Security Issues in the NFT Ecosystem

Dipanjan Das, Christopher Kruegel, Giovanni Vigna et al.

A Deep Dive into NFT Whales: A Longitudinal Study of the NFT Trading Ecosystem

Chanhee Lee, Seungwon Shin, Seunghyeon Lee et al.

Intellectual Property Rights and Entrepreneurship in the NFT Ecosystem: Legal Frameworks, Business Models, and Innovation Opportunities

Pranav Darshan, Rohan J S, Raghuveer Rajesh et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)