Authors

Summary

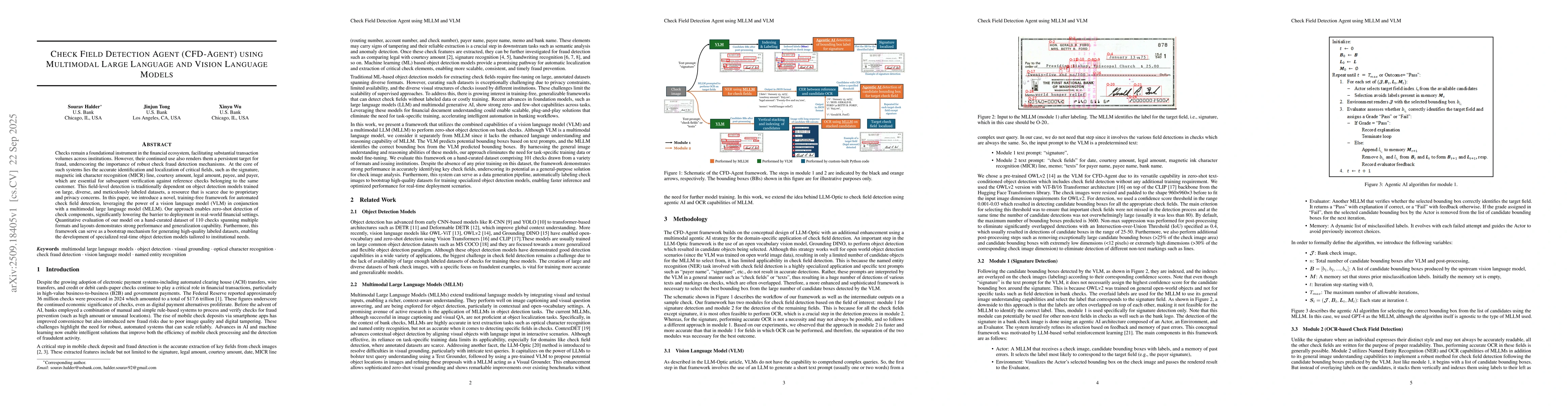

Checks remain a foundational instrument in the financial ecosystem, facilitating substantial transaction volumes across institutions. However, their continued use also renders them a persistent target for fraud, underscoring the importance of robust check fraud detection mechanisms. At the core of such systems lies the accurate identification and localization of critical fields, such as the signature, magnetic ink character recognition (MICR) line, courtesy amount, legal amount, payee, and payer, which are essential for subsequent verification against reference checks belonging to the same customer. This field-level detection is traditionally dependent on object detection models trained on large, diverse, and meticulously labeled datasets, a resource that is scarce due to proprietary and privacy concerns. In this paper, we introduce a novel, training-free framework for automated check field detection, leveraging the power of a vision language model (VLM) in conjunction with a multimodal large language model (MLLM). Our approach enables zero-shot detection of check components, significantly lowering the barrier to deployment in real-world financial settings. Quantitative evaluation of our model on a hand-curated dataset of 110 checks spanning multiple formats and layouts demonstrates strong performance and generalization capability. Furthermore, this framework can serve as a bootstrap mechanism for generating high-quality labeled datasets, enabling the development of specialized real-time object detection models tailored to institutional needs.

AI Key Findings

Generated Sep 29, 2025

Methodology

The research introduces a training-free framework called CFD-Agent that combines a vision language model (VLM) and a multimodal large language model (MLLM) for zero-shot check field detection. It uses OWLv2 as the VLM for object detection and GPT-4 as the MLLM for reasoning and OCR tasks. The framework involves two modules: one for signature detection using an agentic AI architecture, and another for OCR-based field detection using named entity recognition (NER) and character error rate (CER) evaluation.

Key Results

- CFD-Agent achieved significantly higher mean intersection over union (mIOU) scores compared to LLM-Optic, with an overall mIOU of 0.698 vs. 0.360.

- The framework demonstrated strong performance in detecting and localizing check fields, particularly in challenging areas like legal amount, payer name, and MICR lines.

- The CER results showed that GPT-4 performed well in most fields, with a weighted average CER of 0.070 across all 8 check fields, except for MICR and payer name which had higher error rates.

Significance

This research is significant because it addresses the challenge of check fraud detection by enabling automated, zero-shot detection of critical financial fields without requiring large labeled datasets. The framework's ability to generalize across diverse check formats and layouts makes it highly applicable in real-world financial systems, enhancing security and efficiency in document processing.

Technical Contribution

The technical contribution lies in the integration of agentic reasoning with multimodal models for precise field localization, along with the use of CER-informed filtering to resolve ambiguities in visually similar regions like MICR fields.

Novelty

The novelty of this work is the combination of agentic AI with VLM and MLLM for zero-shot check field detection, along with the use of CER thresholds to dynamically guide localization decisions, which is a departure from traditional methods relying solely on label identification.

Limitations

- The framework's performance on long handwritten fields like legal amount was partially limited due to the VLM's inability to fully encapsulate these fields.

- The reliance on GPT-4 and OWLv2 may limit flexibility and could benefit from specialized models for document analysis.

Future Work

- Investigating prompt engineering strategies to improve OCR accuracy for MICR fields.

- Exploring the use of different MLLMs and VLMs to optimize performance for specific document types.

- Developing more advanced post-processing techniques to handle overlapping candidate predictions.

Paper Details

PDF Preview

Similar Papers

Found 4 papersMultimodal Misinformation Detection using Large Vision-Language Models

Sahar Tahmasebi, Eric Müller-Budack, Ralph Ewerth

VisionGPT: Vision-Language Understanding Agent Using Generalized Multimodal Framework

Zihao Li, Yu Tian, Yuexian Zou et al.

MedChat: A Multi-Agent Framework for Multimodal Diagnosis with Large Language Models

Xin Wang, Shu Hu, Neeraj Gupta et al.

AViLA: Asynchronous Vision-Language Agent for Streaming Multimodal Data Interaction

Jindong Gu, Volker Tresp, Xinyu Xie et al.

Comments (0)