Summary

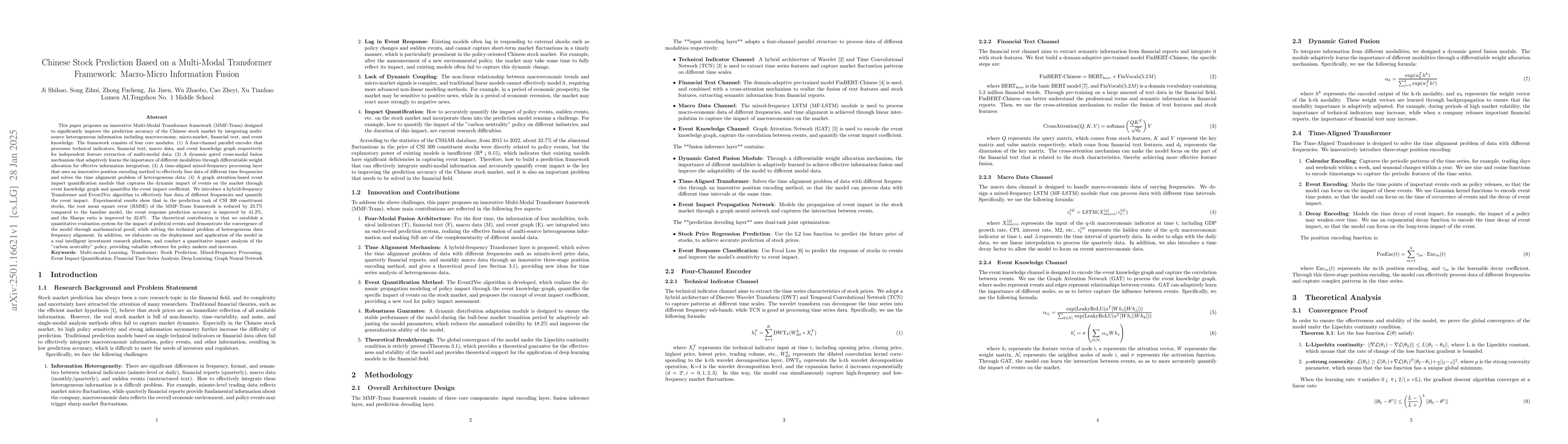

This paper proposes an innovative Multi-Modal Transformer framework (MMF-Trans) designed to significantly improve the prediction accuracy of the Chinese stock market by integrating multi-source heterogeneous information including macroeconomy, micro-market, financial text, and event knowledge. The framework consists of four core modules: (1) A four-channel parallel encoder that processes technical indicators, financial text, macro data, and event knowledge graph respectively for independent feature extraction of multi-modal data; (2) A dynamic gated cross-modal fusion mechanism that adaptively learns the importance of different modalities through differentiable weight allocation for effective information integration; (3) A time-aligned mixed-frequency processing layer that uses an innovative position encoding method to effectively fuse data of different time frequencies and solves the time alignment problem of heterogeneous data; (4) A graph attention-based event impact quantification module that captures the dynamic impact of events on the market through event knowledge graph and quantifies the event impact coefficient. We introduce a hybrid-frequency Transformer and Event2Vec algorithm to effectively fuse data of different frequencies and quantify the event impact. Experimental results show that in the prediction task of CSI 300 constituent stocks, the root mean square error (RMSE) of the MMF-Trans framework is reduced by 23.7% compared to the baseline model, the event response prediction accuracy is improved by 41.2%, and the Sharpe ratio is improved by 32.6%.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCFSum: A Transformer-Based Multi-Modal Video Summarization Framework With Coarse-Fine Fusion

Yong Liu, Demetri Terzopoulos, Chenfanfu Jiang et al.

Tile Classification Based Viewport Prediction with Multi-modal Fusion Transformer

Qi Wang, Zhihao Zhang, Weizhan Zhang et al.

Multi-scale multi-modal micro-expression recognition algorithm based on transformer

Lin Wang, Jie Li, Fengping Wang et al.

No citations found for this paper.

Comments (0)