Summary

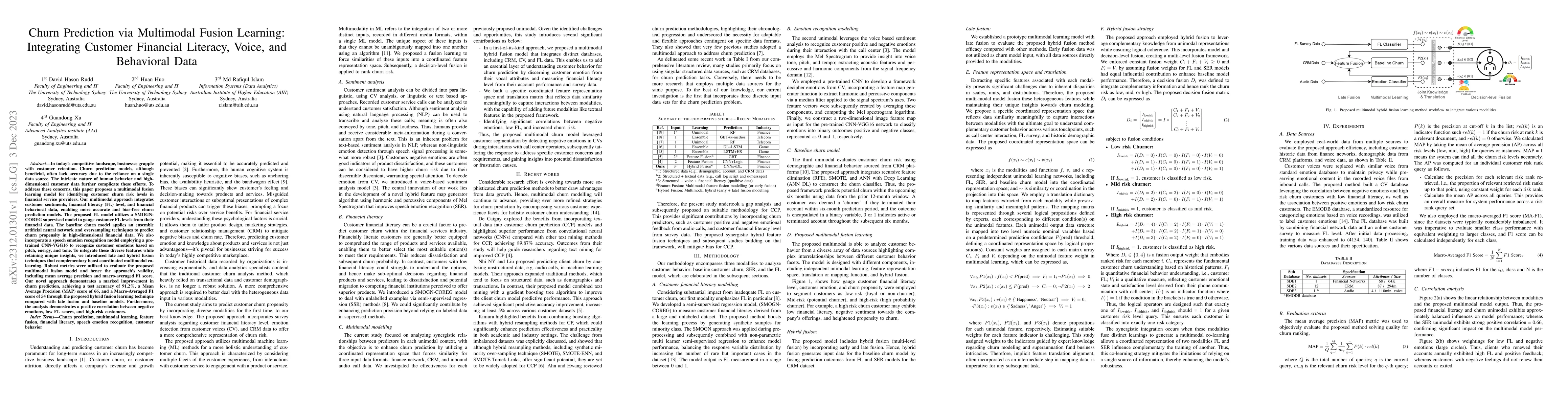

In todays competitive landscape, businesses grapple with customer retention. Churn prediction models, although beneficial, often lack accuracy due to the reliance on a single data source. The intricate nature of human behavior and high dimensional customer data further complicate these efforts. To address these concerns, this paper proposes a multimodal fusion learning model for identifying customer churn risk levels in financial service providers. Our multimodal approach integrates customer sentiments financial literacy (FL) level, and financial behavioral data, enabling more accurate and bias-free churn prediction models. The proposed FL model utilizes a SMOGN COREG supervised model to gauge customer FL levels from their financial data. The baseline churn model applies an ensemble artificial neural network and oversampling techniques to predict churn propensity in high-dimensional financial data. We also incorporate a speech emotion recognition model employing a pre-trained CNN-VGG16 to recognize customer emotions based on pitch, energy, and tone. To integrate these diverse features while retaining unique insights, we introduced late and hybrid fusion techniques that complementary boost coordinated multimodal co learning. Robust metrics were utilized to evaluate the proposed multimodal fusion model and hence the approach validity, including mean average precision and macro-averaged F1 score. Our novel approach demonstrates a marked improvement in churn prediction, achieving a test accuracy of 91.2%, a Mean Average Precision (MAP) score of 66, and a Macro-Averaged F1 score of 54 through the proposed hybrid fusion learning technique compared with late fusion and baseline models. Furthermore, the analysis demonstrates a positive correlation between negative emotions, low FL scores, and high-risk customers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCustomer Churn Prediction Model using Explainable Machine Learning

Jitendra Maan, Harsh Maan

No citations found for this paper.

Comments (0)