Authors

Summary

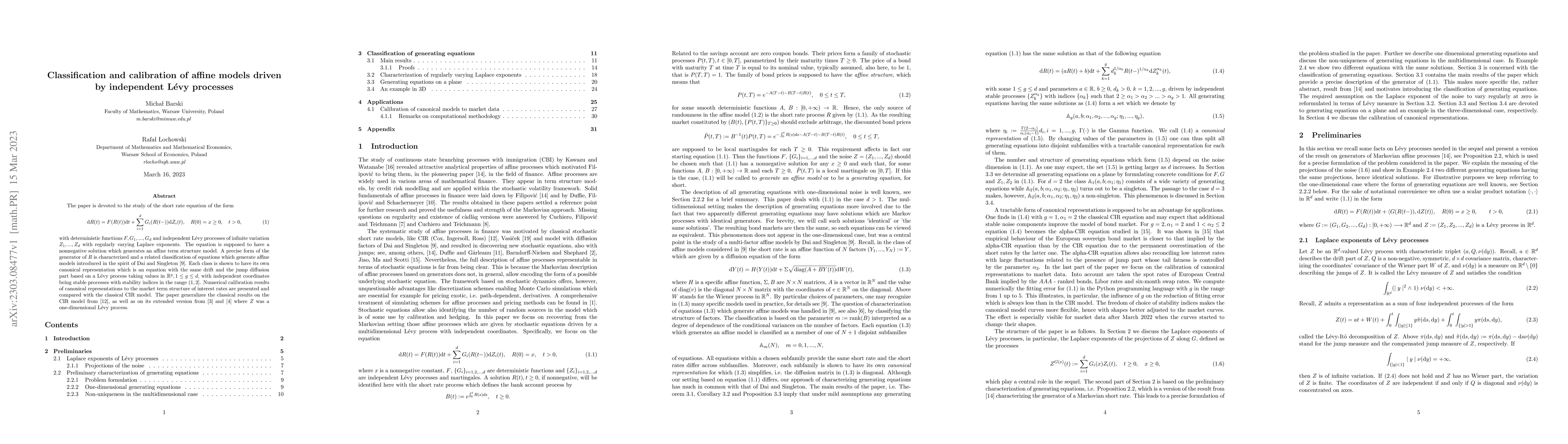

The paper is devoted to the study of the short rate equation of the form $$ dR(t)=F(R(t))dt+\sum_{i=1}^{d}G_i(R(t-))dZ_i(t), \quad R(0)=x\geq 0, \quad t>0, $$ with deterministic functions $F,G_1,...,G_d$ and independent L\'evy processes of infinite variation $Z_1,...,Z_d$ with regularly varying Laplace exponents. The equation is supposed to have a nonnegative solution which generates an affine term structure model. A precise form of the generator of $R$ is characterized and a related classification of equations which generate affine models introduced in the spirit of Dai and Singleton \cite{DaiSingleton}. Each class is shown to have its own canonical representation which is an equation with the same drift and the jump diffusion part based on a L\'evy process taking values in $\mathbb{R}^{g}, 1\leq g\leq d$, with independent coordinates being stable processes with stability indices in the range $(1,2]$. Numerical calibration results of canonical representations to the market term structure of interest rates are presented and compared with the classical CIR model. The paper generalizes the classical results on the CIR model from \cite{CIR}, as well as on its extended version from \cite{BarskiZabczykCIR} and \cite{BarskiZabczyk} where $Z$ was a one-dimensional L\'evy process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAffine term structure models driven by independent L\'evy processes

Michał Barski, Rafał Łochowski

No citations found for this paper.

Comments (0)