Summary

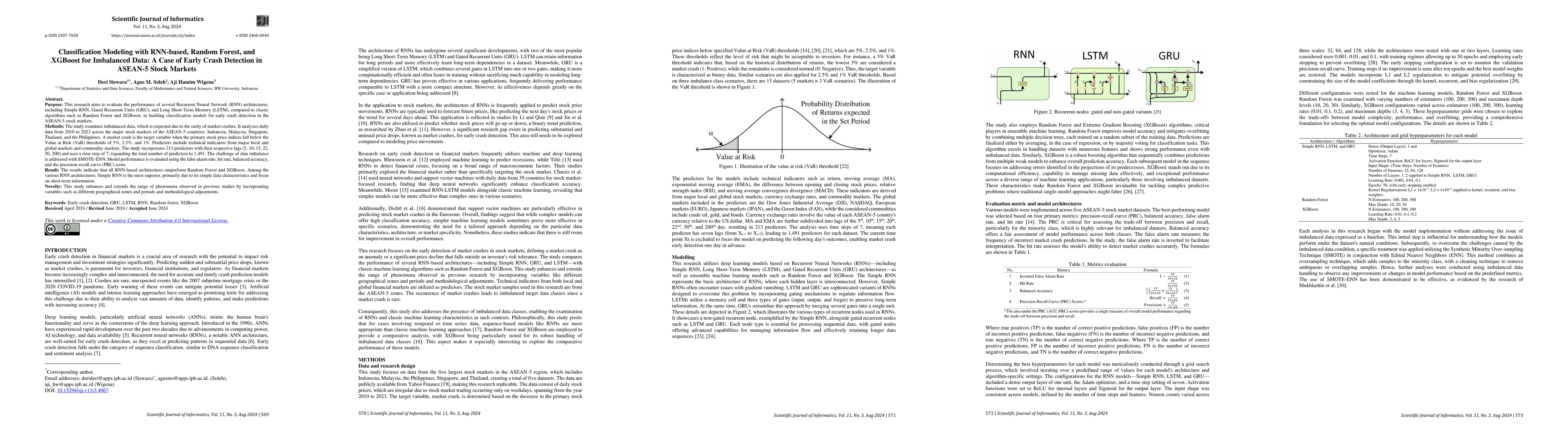

This research aims to evaluate the performance of several Recurrent Neural Network (RNN) architectures including Simple RNN, Gated Recurrent Units (GRU), and Long Short-Term Memory (LSTM), compared to classic algorithms such as Random Forest and XGBoost in building classification models for early crash detection in ASEAN-5 stock markets. The study is examined using imbalanced data, which is common due to the rarity of market crashes. The study analyzes daily data from 2010 to 2023 across the major stock markets of the ASEAN-5 countries, including Indonesia, Malaysia, Singapore, Thailand, and Philippines. Market crash is identified as the target variable when the major stock price indices fall below the Value at Risk (VaR) thresholds of 5%, 2.5% and 1%. predictors involving technical indicators of major local and global markets as well as commodity markets. This study includes 213 predictors with their respective lags (5, 10, 15, 22, 50, 200) and uses a time step of 7, expanding the total number of predictors to 1491. The challenge of data imbalance is addressed with SMOTE-ENN. The results show that all RNN-Based architectures outperform Random Forest and XGBoost. Among the various RNN architectures, Simple RNN stands out as the most superior, mainly due to the data characteristics that are not overly complex and focus more on short-term information. This study enhances and extends the range of phenomena observed in previous studies by incorporating variables like different geographical zones and time periods, as well as methodological adjustments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Generative Deep Learning Approach for Crash Severity Modeling with Imbalanced Data

Ziyuan Pu, Nan Zheng, Xiao Wen et al.

Evaluating XGBoost for Balanced and Imbalanced Data: Application to Fraud Detection

Gissel Velarde, Anindya Sudhir, Sanjay Deshmane et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)