Summary

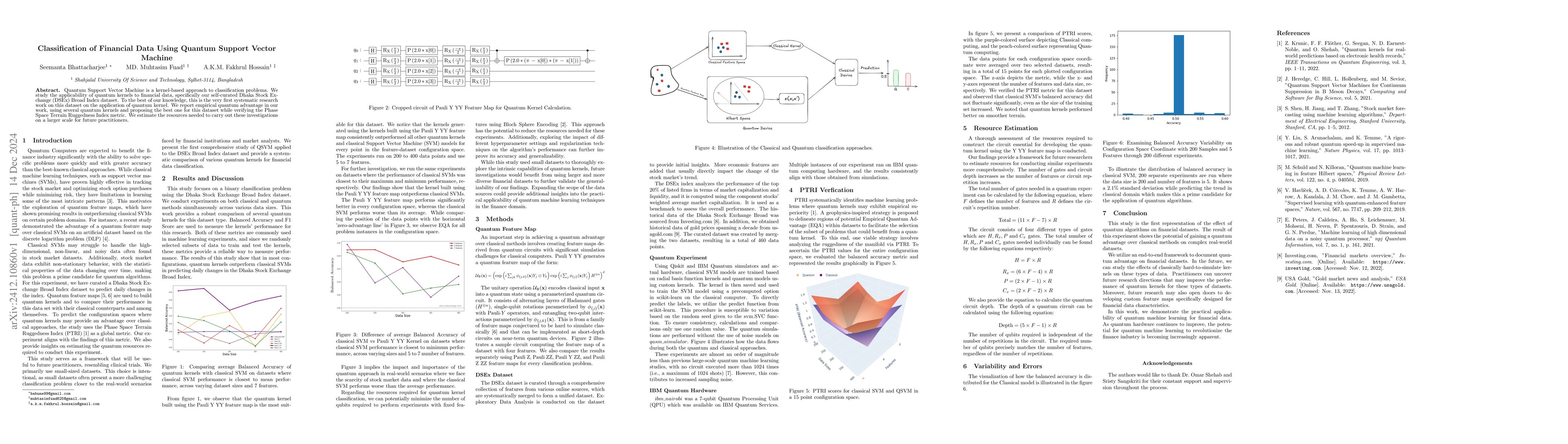

Quantum Support Vector Machine is a kernel-based approach to classification problems. We study the applicability of quantum kernels to financial data, specifically our self-curated Dhaka Stock Exchange (DSEx) Broad Index dataset. To the best of our knowledge, this is the very first systematic research work on this dataset on the application of quantum kernel. We report empirical quantum advantage in our work, using several quantum kernels and proposing the best one for this dataset while verifying the Phase Space Terrain Ruggedness Index metric. We estimate the resources needed to carry out these investigations on a larger scale for future practitioners.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNon-Hemolytic Peptide Classification Using A Quantum Support Vector Machine

Jingbo Wang, Yusen Wu, Nicolas Fontaine et al.

A quantum-enhanced support vector machine for galaxy classification

Ofer Lahav, Marcin Jastrzebski, Sarah Malik et al.

No citations found for this paper.

Comments (0)