Summary

We propose a model for price formation in financial markets based on clearing of a standard call auction with random orders, and verify its validity for prediction of the daily closing price distribution statistically. The model considers random buy and sell orders, placed following demand- and supply-side valuation distributions; an equilibrium equation then leads to a distribution for clearing price and transacted volume. Bid and ask volumes are left as free parameters, permitting possibly heavy-tailed or very skewed order flow conditions. In highly liquid auctions, the clearing price distribution converges to an asymptotically normal central limit, with mean and variance in terms of supply/demand-valuation distributions and order flow imbalance. By means of simulations, we illustrate the influence of variations in order flow and valuation distributions on price/volume, noting a distinction between high- and low-volume auction price variance. To verify the validity of the model statistically, we predict a year's worth of daily closing price distributions for 5 constituents of the Eurostoxx 50 index; Kolmogorov-Smirnov statistics and QQ-plots demonstrate with ample statistical significance that the model predicts closing price distributions accurately, and compares favourably with alternative methods of prediction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

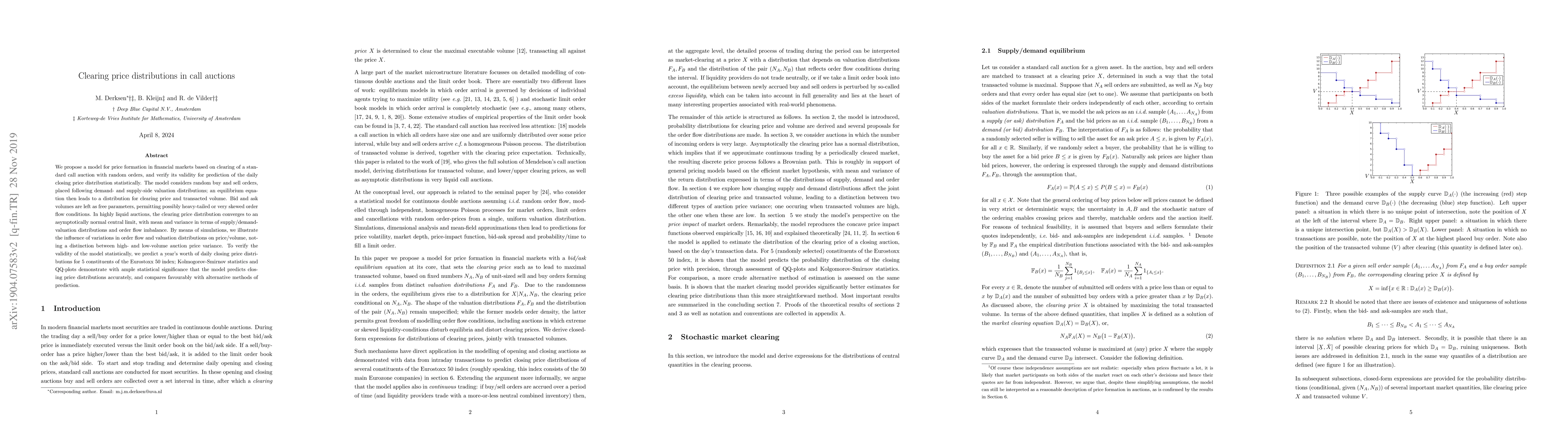

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice Manipulability in First-Price Auctions

Paul Dütting, Balasubramanian Sivan, Johannes Brustle

| Title | Authors | Year | Actions |

|---|

Comments (0)