Summary

Constraints on agent's ability to pay play a major role in auction design for any setting where the magnitude of financial transactions is sufficiently large. Those constraints have been traditionally modeled in mechanism design as \emph{hard budget}, i.e., mechanism is not allowed to charge agents more than a certain amount. Yet, real auction systems (such as Google AdWords) allow more sophisticated constraints on agents' ability to pay, such as \emph{average budgets}. In this work, we investigate the design of Pareto optimal and incentive compatible auctions for agents with \emph{constrained quasi-linear utilities}, which captures more realistic models of liquidity constraints that the agents may have. Our result applies to a very general class of allocation constraints known as polymatroidal environments, encompassing many settings of interest such as multi-unit auctions, matching markets, video-on-demand and advertisement systems. Our design is based Ausubel's \emph{clinching framework}. Incentive compatibility and feasibility with respect to ability-to-pay constraints are direct consequences of the clinching framework. Pareto-optimality, on the other hand, is considerably more challenging, since the no-trade condition that characterizes it depends not only on whether agents have their budgets exhausted or not, but also on prices {at} which the goods are allocated. In order to get a handle on those prices, we introduce novel concepts of dropping prices and saturation. These concepts lead to our main structural result which is a characterization of the tight sets in the clinching auction outcome and its relation to dropping prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

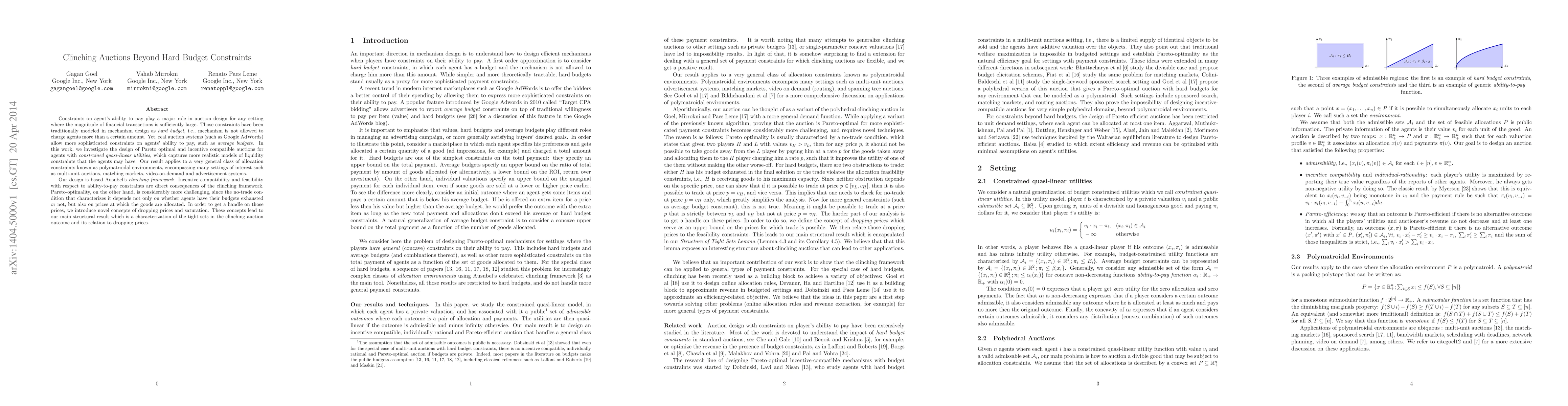

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)