Summary

We introduce the Clockwork Finance Framework (CFF), a general purpose, formal verification framework for mechanized reasoning about the economic security properties of composed decentralized-finance (DeFi) smart contracts. CFF features three key properties. It is contract complete, meaning that it can model any smart contract platform and all its contracts--Turing complete or otherwise. It does so with asymptotically constant model overhead. It is also attack-exhaustive by construction, meaning that it can automatically and mechanically extract all possible economic attacks on users' cryptocurrency across modeled contracts. Thanks to these properties, CFF can support multiple goals: economic security analysis of contracts by developers, analysis of DeFi trading risks by users, fees UX, and optimization of arbitrage opportunities by bots or miners. Because CFF offers composability, it can support these goals with reasoning over any desired set of potentially interacting smart contract models. We instantiate CFF as an executable model for Ethereum contracts that incorporates a state-of-the-art deductive verifier. Building on previous work, we introduce extractable value (EV), a new formal notion of economic security in composed DeFi contracts that is both a basis for CFF and of general interest. We construct modular, human-readable, composable CFF models of four popular, deployed DeFi protocols in Ethereum: Uniswap, Uniswap V2, Sushiswap, and MakerDAO, representing a combined 24 billion USD in value as of March 2022. We use these models along with some other common models such as flash loans, airdrops and voting to show experimentally that CFF is practical and can drive useful, data-based EV-based insights from real world transaction activity. Without any explicitly programmed attack strategies, CFF uncovers on average an expected $56 million of EV per month in the recent past.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

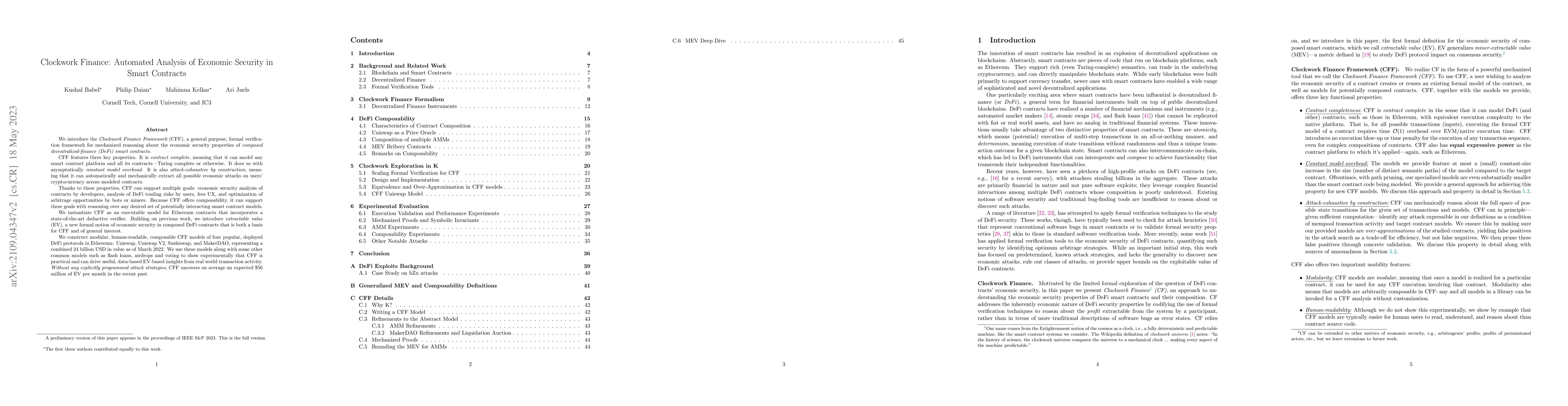

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Automated Analyzer for Financial Security of Ethereum Smart Contracts

Zhaoyi Meng, Wansen Wang, Wenchao Huang et al.

HoRStify: Sound Security Analysis of Smart Contracts

Sebastian Biewer, Clara Schneidewind, Sebastian Holler

| Title | Authors | Year | Actions |

|---|

Comments (0)