Summary

Drawing insights from the triumph of relativistic over classical mechanics when velocities approach the speed of light, we explore a similar improvement to the seminal Black-Scholes (Black and Scholes (1973)) option pricing formula by considering a relativist version of it, and then finding a respective solution. We show that our solution offers a significant improvement over competing solutions (e.g., Romero and Zubieta-Martinez (2016)), and obtain a new closed-form option pricing formula, containing the speed limit of information transfer c as a new parameter. The new formula is rigorously shown to converge to the Black-Scholes formula as c goes to infinity. When c is finite, the new formula can flatten the standard volatility smile which is more consistent with empirical observations. In addition, an alternative family of distributions for stock prices arises from our new formula, which offer a better fit, are shown to converge to lognormal, and help to better explain the volatility skew.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

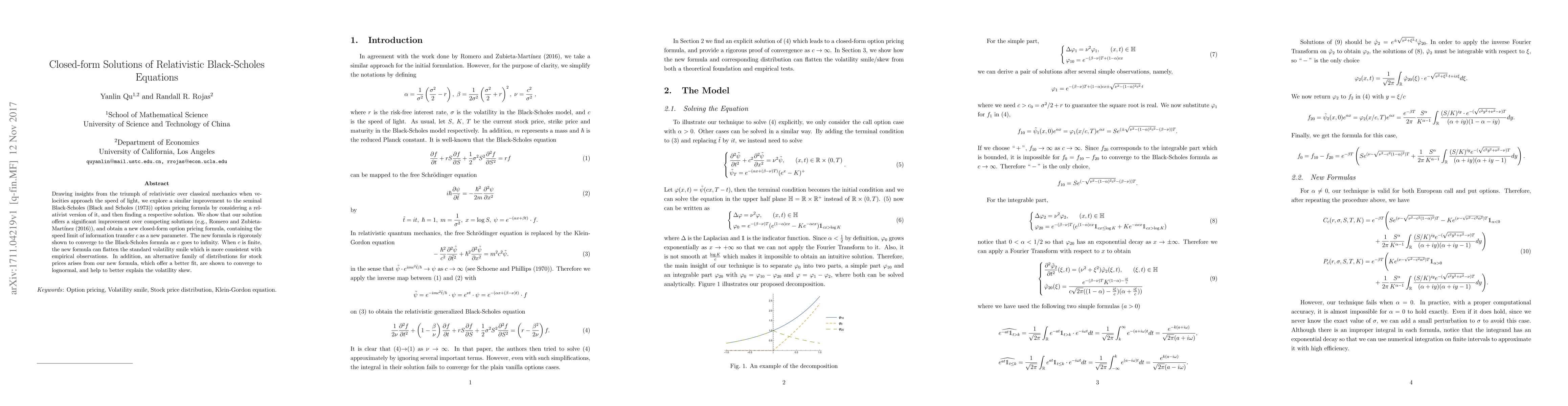

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersChaos for generalized Black-Scholes equations

Anna Maria Candela, Gisèle Ruiz Goldstein, Jerome A. Goldstein et al.

No citations found for this paper.

Comments (0)