Summary

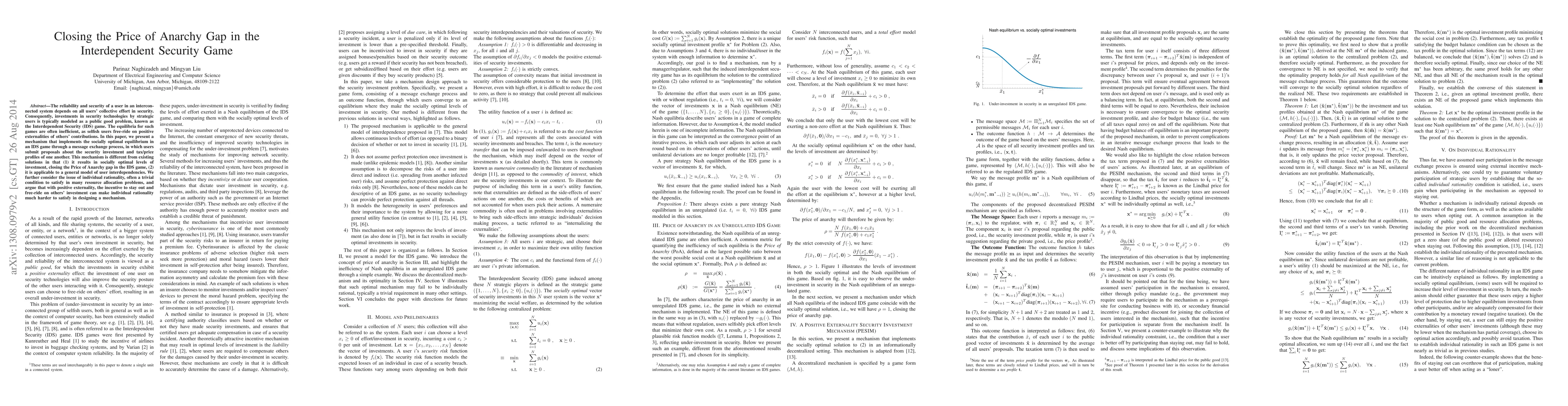

The reliability and security of a user in an interconnected system depends on all users' collective effort in security. Consequently, investments in security technologies by strategic users is typically modeled as a public good problem, known as the Interdependent Security (IDS) game. The equilibria for such games are often inefficient, as selfish users free-ride on positive externalities of others' contributions. In this paper, we present a mechanism that implements the socially optimal equilibrium in an IDS game through a message exchange process, in which users submit proposals about the security investment and tax/price profiles of one another. This mechanism is different from existing solutions in that (1) it results in socially optimal levels of investment, closing the Price of Anarchy gap in the IDS game, (2) it is applicable to a general model of user interdependencies. We further consider the issue of individual rationality, often a trivial condition to satisfy in many resource allocation problems, and argue that with positive externality, the incentive to stay out and free-ride on others' investment can make individual rationality much harder to satisfy in designing a mechanism.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)