Summary

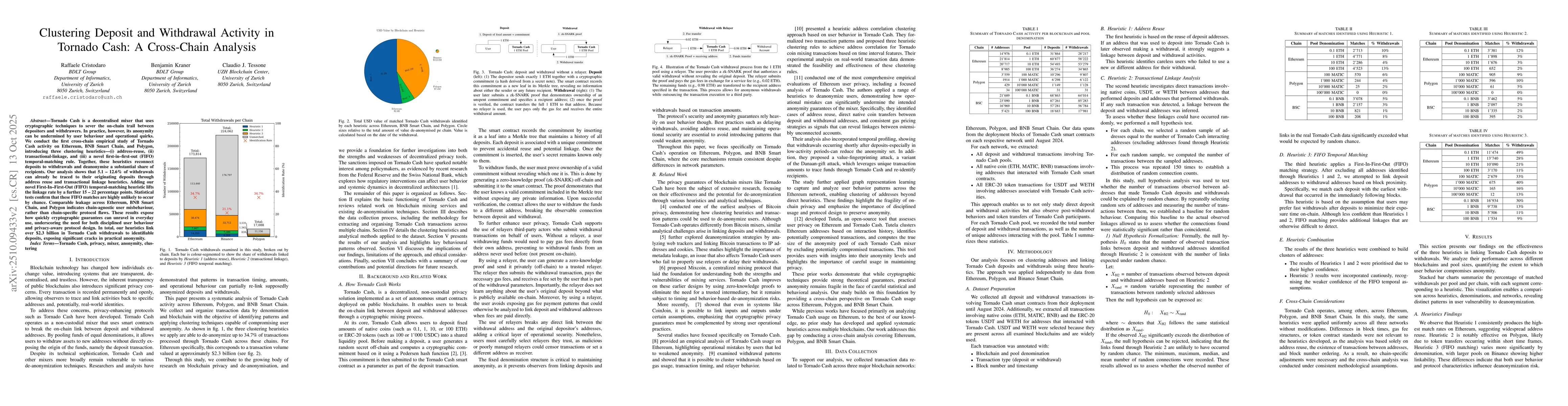

Tornado Cash is a decentralised mixer that uses cryptographic techniques to sever the on-chain trail between depositors and withdrawers. In practice, however, its anonymity can be undermined by user behaviour and operational quirks. We conduct the first cross-chain empirical study of Tornado Cash activity on Ethereum, BNB Smart Chain, and Polygon, introducing three clustering heuristics-(i) address-reuse, (ii) transactional-linkage, and (iii) a novel first-in-first-out (FIFO) temporal-matching rule. Together, these heuristics reconnect deposits to withdrawals and deanonymise a substantial share of recipients. Our analysis shows that 5.1 - 12.6% of withdrawals can already be traced to their originating deposits through address reuse and transactional linkage heuristics. Adding our novel First-In-First-Out (FIFO) temporal-matching heuristic lifts the linkage rate by a further 15 - 22 percentage points. Statistical tests confirm that these FIFO matches are highly unlikely to occur by chance. Comparable leakage across Ethereum, BNB Smart Chain, and Polygon indicates chain-agnostic user misbehaviour, rather than chain-specific protocol flaws. These results expose how quickly cryptographic guarantees can unravel in everyday use, underscoring the need for both disciplined user behaviour and privacy-aware protocol design. In total, our heuristics link over $2.3 billion in Tornado Cash withdrawals to identifiable deposits, exposing significant cracks in practical anonymity.

AI Key Findings

Generated Oct 16, 2025

Methodology

The study employed three clustering heuristics: address reuse, transactional linkage, and FIFO temporal matching to link Tornado Cash deposits to withdrawals across Ethereum, BNB Smart Chain, and Polygon. These heuristics were applied to transaction data spanning from the deployment of Tornado Cash smart contracts until August 2024.

Key Results

- Address reuse and transactional linkage identified 5.1-12.6% of withdrawals linked to deposits.

- The FIFO temporal matching heuristic increased linkage rates by 15-22 percentage points, reaching up to 49% for certain pools.

- Over $2.3 billion in Tornado Cash withdrawals were linked to identifiable deposits across all analyzed chains.

Significance

This research highlights the practical vulnerabilities of decentralized mixers like Tornado Cash, demonstrating how user behavior can undermine cryptographic privacy guarantees. The findings underscore the importance of operational discipline in maintaining anonymity in blockchain systems.

Technical Contribution

The paper introduces a comprehensive framework for analyzing privacy vulnerabilities in decentralized mixers through multi-chain transaction analysis and temporal pattern recognition.

Novelty

This work is novel in its cross-chain analysis approach, combining address reuse, transaction linkage, and temporal matching heuristics to provide a more holistic view of privacy risks in decentralized finance systems.

Limitations

- The analysis focuses on on-chain data and does not account for off-chain metadata that could further reveal user identities.

- Results are specific to the analyzed chains and may not generalize to other blockchain networks.

- The study assumes users follow predictable patterns, which may not hold for all privacy-conscious users.

Future Work

- Exploring advanced clustering methods like machine learning models incorporating transaction graph embeddings.

- Investigating the integration of off-chain metadata to enhance de-anonymization capabilities.

- Developing privacy-preserving tools with built-in operational safeguards against common user errors.

Paper Details

PDF Preview

Similar Papers

Found 5 papersTutela: An Open-Source Tool for Assessing User-Privacy on Ethereum and Tornado Cash

Kaili Wang, Mariano Mendez, Mike Wu et al.

CONNECTOR: Enhancing the Traceability of Decentralized Bridge Applications via Automatic Cross-chain Transaction Association

Dan Lin, Zibin Zheng, Bowen Song et al.

Promoting Shared Energy Storage Aggregation among High Price-Tolerance Prosumer: An Incentive Deposit and Withdrawal Service

Xin Lu, Jing Qiu, Jianguo Zhu et al.

Comments (0)