Authors

Summary

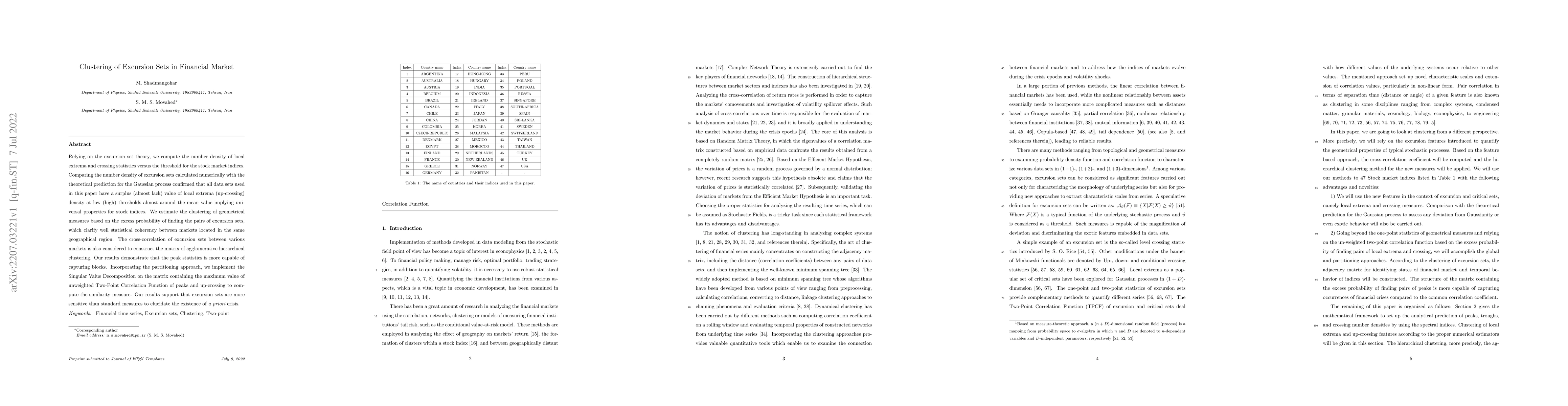

Relying on the excursion set theory, we compute the number density of local extrema and crossing statistics versus the threshold for the stock market indices. Comparing the number density of excursion sets calculated numerically with the theoretical prediction for the Gaussian process confirmed that all data sets used in this paper have a surplus (almost lack) value of local extrema (up-crossing) density at low (high) thresholds almost around the mean value implying universal properties for stock indices. We estimate the clustering of geometrical measures based on the excess probability of finding the pairs of excursion sets, which clarify well statistical coherency between markets located in the same geographical region. The cross-correlation of excursion sets between various markets is also considered to construct the matrix of agglomerative hierarchical clustering. Our results demonstrate that the peak statistics is more capable of capturing blocks. Incorporating the partitioning approach, we implement the Singular Value Decomposition on the matrix containing the maximum value of unweighted Two-Point Correlation Function of peaks and up-crossing to compute the similarity measure. Our results support that excursion sets are more sensitive than standard measures to elucidate the existence of {\it a priori} crisis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)