Authors

Summary

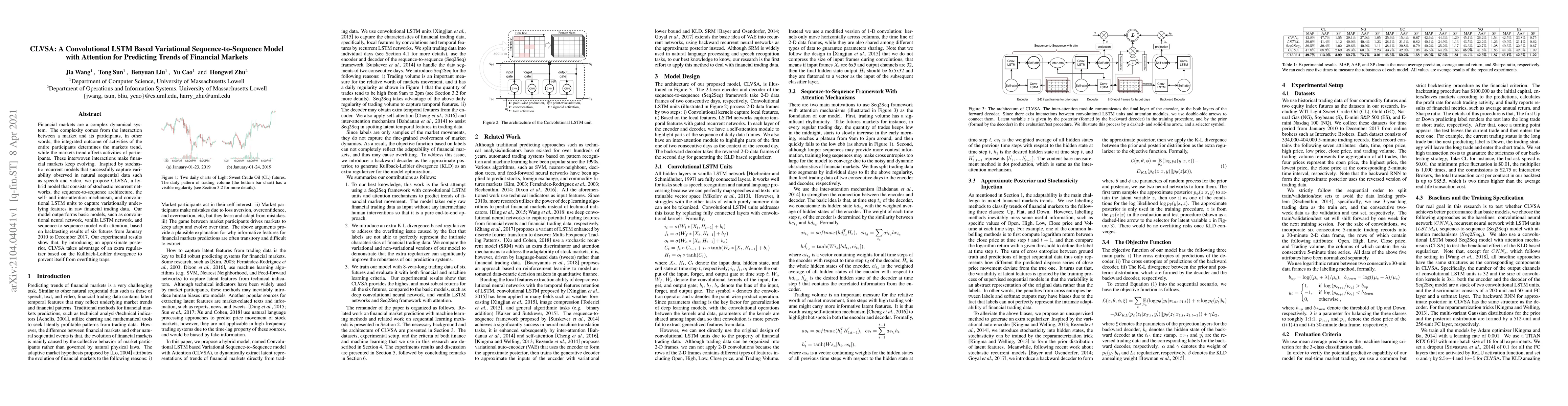

Financial markets are a complex dynamical system. The complexity comes from the interaction between a market and its participants, in other words, the integrated outcome of activities of the entire participants determines the markets trend, while the markets trend affects activities of participants. These interwoven interactions make financial markets keep evolving. Inspired by stochastic recurrent models that successfully capture variability observed in natural sequential data such as speech and video, we propose CLVSA, a hybrid model that consists of stochastic recurrent networks, the sequence-to-sequence architecture, the self- and inter-attention mechanism, and convolutional LSTM units to capture variationally underlying features in raw financial trading data. Our model outperforms basic models, such as convolutional neural network, vanilla LSTM network, and sequence-to-sequence model with attention, based on backtesting results of six futures from January 2010 to December 2017. Our experimental results show that, by introducing an approximate posterior, CLVSA takes advantage of an extra regularizer based on the Kullback-Leibler divergence to prevent itself from overfitting traps.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDual-CLVSA: a Novel Deep Learning Approach to Predict Financial Markets with Sentiment Measurements

Yu Cao, Jia Wang, Benyuan Liu et al.

Temporal Convolutional Attention-based Network For Sequence Modeling

Yan Wang, Jian Zhao, Siqiao Xue et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)