Authors

Summary

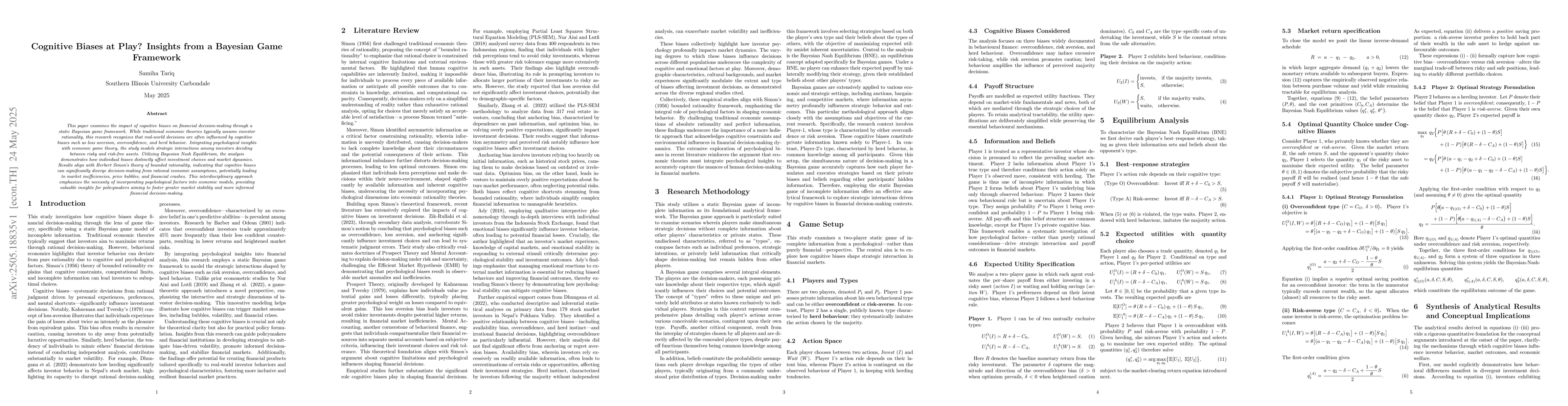

This paper examines the impact of cognitive biases on financial decision-making through a static Bayesian game framework. While traditional economic theory assumes fully rational investors, real-world choices are often shaped by loss aversion, overconfidence, and herd behavior. Integrating psychological insights with economic game theory, the model studies strategic interactions among investors who allocate wealth between risky and risk-free assets. Solving for the Bayesian Nash Equilibrium reveals that each bias distorts optimal portfolios and alters aggregate market dynamics. The results echo Herbert Simon's notion of bounded rationality, showing how biases can generate market inefficiencies, price bubbles, and crashes. The findings highlight the importance of incorporating psychological factors into economic models to guide policies that foster market stability and more informed financial decision-making.

AI Key Findings

Generated Jun 07, 2025

Methodology

The research employs a static Bayesian game framework to analyze the impact of cognitive biases on financial decision-making, integrating psychological insights with economic game theory.

Key Results

- Cognitive biases like loss aversion, overconfidence, and herd behavior distort optimal portfolios of investors.

- Each bias alters aggregate market dynamics, generating market inefficiencies, price bubbles, and crashes.

- Findings support Herbert Simon's notion of bounded rationality in financial decision-making.

Significance

This research underscores the importance of incorporating psychological factors into economic models to enhance market stability and promote informed financial decisions.

Technical Contribution

The paper presents a novel application of Bayesian game theory to understand the influence of cognitive biases on financial decision-making and market outcomes.

Novelty

By merging psychological insights with economic game theory, this research offers a fresh perspective on market inefficiencies, distinguishing itself from traditional rational expectations models.

Limitations

- The study focuses on a static Bayesian game framework, which may not capture the full complexity and dynamics of real-world financial markets.

- Findings are based on assumptions and models, which may not account for all individual and contextual variations in investor behavior.

Future Work

- Explore dynamic models to capture evolving market conditions and investor behavior over time.

- Investigate the interplay of multiple biases and their compounding effects on financial decision-making.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCBEval: A framework for evaluating and interpreting cognitive biases in LLMs

Raj Abhijit Dandekar, Rajat Dandekar, Sreedath Panat et al.

A Comprehensive Evaluation of Cognitive Biases in LLMs

Georg Groh, Simon Malberg, Roman Poletukhin et al.

No citations found for this paper.

Comments (0)