Summary

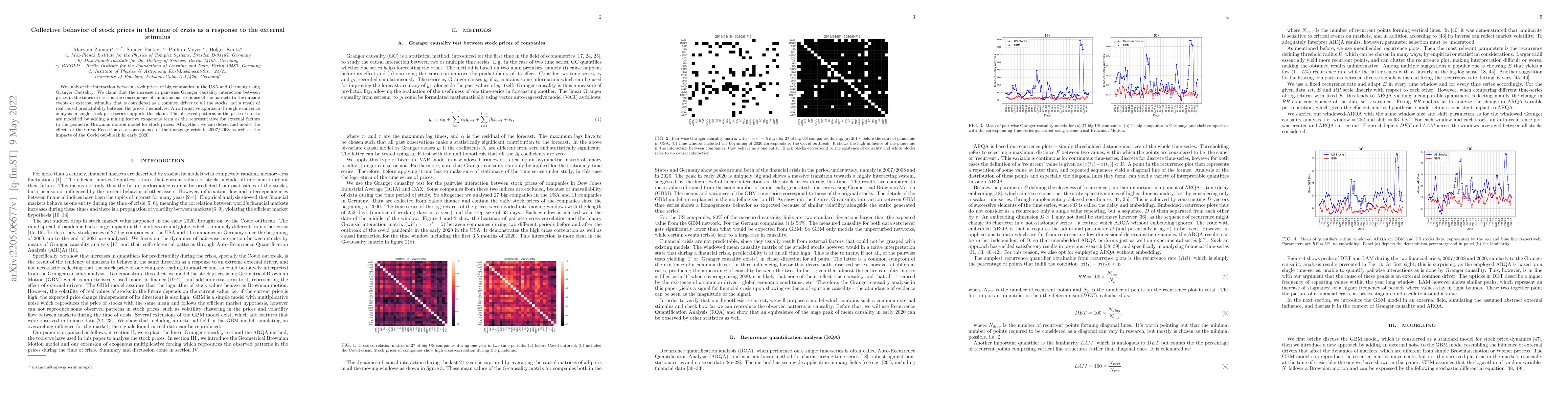

We analyze the interaction between stock prices of big companies in the USA and Germany using Granger Causality. We claim that the increase in pair-wise Granger causality interaction between prices in the times of crisis is the consequence of simultaneous response of the markets to the outside events or external stimulus that is considered as a common driver to all the stocks, not a result of real causal predictability between the prices themselves. An alternative approach through recurrence analysis in single stock price series supports this claim. The observed patterns in the price of stocks are modelled by adding a multiplicative exogenous term as the representative for external factors to the geometric Brownian motion model for stock prices. Altogether, we can detect and model the effects of the Great Recession as a consequence of the mortgage crisis in 2007/2008 as well as the impacts of the Covid out-break in early 2020

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)