Summary

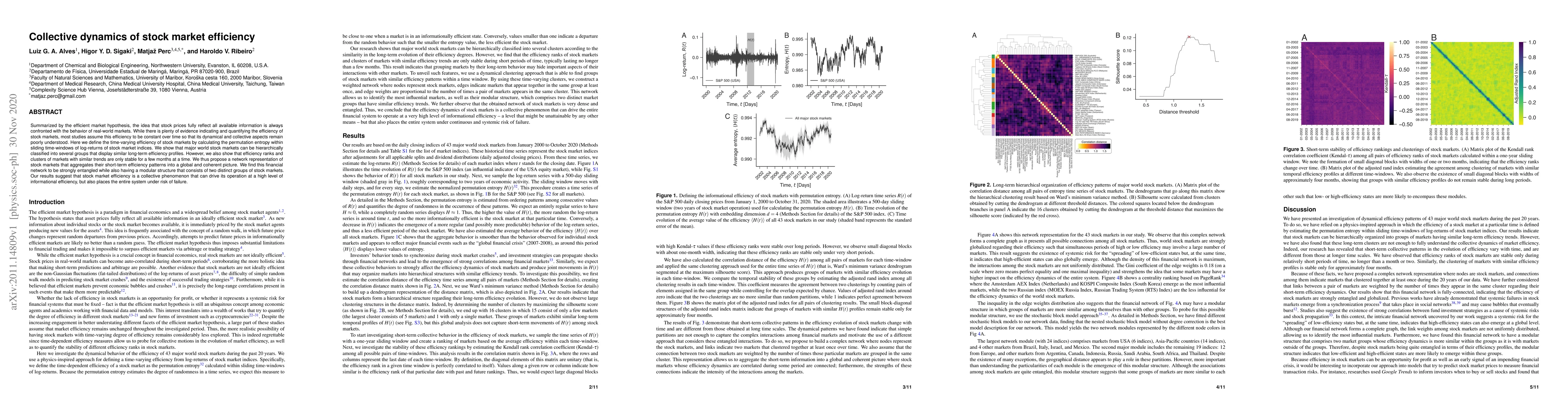

Summarized by the efficient market hypothesis, the idea that stock prices fully reflect all available information is always confronted with the behavior of real-world markets. While there is plenty of evidence indicating and quantifying the efficiency of stock markets, most studies assume this efficiency to be constant over time so that its dynamical and collective aspects remain poorly understood. Here we define the time-varying efficiency of stock markets by calculating the permutation entropy within sliding time-windows of log-returns of stock market indices. We show that major world stock markets can be hierarchically classified into several groups that display similar long-term efficiency profiles. However, we also show that efficiency ranks and clusters of markets with similar trends are only stable for a few months at a time. We thus propose a network representation of stock markets that aggregates their short-term efficiency patterns into a global and coherent picture. We find this financial network to be strongly entangled while also having a modular structure that consists of two distinct groups of stock markets. Our results suggest that stock market efficiency is a collective phenomenon that can drive its operation at a high level of informational efficiency, but also places the entire system under risk of failure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)