Summary

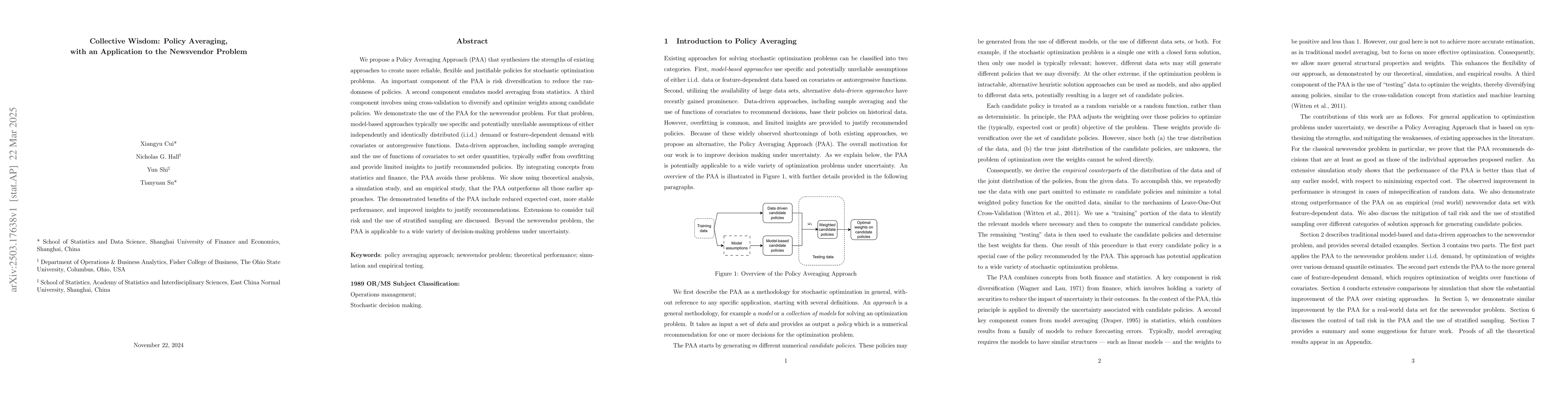

We propose a Policy Averaging Approach (PAA) that synthesizes the strengths of existing approaches to create more reliable, flexible and justifiable policies for stochastic optimization problems. An important component of the PAA is risk diversification to reduce the randomness of policies. A second component emulates model averaging from statistics. A third component involves using cross-validation to diversify and optimize weights among candidate policies. We demonstrate the use of the PAA for the newsvendor problem. For that problem, model-based approaches typically use specific and potentially unreliable assumptions of either independently and identically distributed (i.i.d.) demand or feature-dependent demand with covariates or autoregressive functions. Data-driven approaches, including sample averaging and the use of functions of covariates to set order quantities, typically suffer from overfitting and provide limited insights to justify recommended policies. By integrating concepts from statistics and finance, the PAA avoids these problems. We show using theoretical analysis, a simulation study, and an empirical study, that the PAA outperforms all those earlier approaches. The demonstrated benefits of the PAA include reduced expected cost, more stable performance, and improved insights to justify recommendations. Extensions to consider tail risk and the use of stratified sampling are discussed. Beyond the newsvendor problem, the PAA is applicable to a wide variety of decision-making problems under uncertainty.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research introduces the Policy Averaging Approach (PAA) that combines elements from statistics and finance to tackle stochastic optimization problems, specifically demonstrated on the newsvendor problem.

Key Results

- PAA outperforms traditional model-based and data-driven approaches in terms of reduced expected cost, more stable performance, and improved policy justification.

- PAA avoids issues of overfitting and unreliable assumptions present in existing methods.

- Theoretical analysis, simulation studies, and empirical studies support the superiority of PAA.

Significance

This research is significant as it provides a robust, flexible, and justifiable policy synthesis method for various decision-making problems under uncertainty, surpassing existing approaches in reliability and performance.

Technical Contribution

The main technical contribution is the Policy Averaging Approach (PAA), which integrates risk diversification, model averaging, and cross-validation to create more reliable policies for stochastic optimization.

Novelty

PAA distinguishes itself by merging concepts from statistics and finance, addressing shortcomings of both model-based and data-driven approaches, and offering improved performance and insights.

Limitations

- The paper does not discuss potential computational complexities that might arise with PAA, especially with a large number of candidate policies.

- The generalizability of PAA to all types of stochastic optimization problems beyond the newsvendor problem is assumed but not extensively validated.

Future Work

- Investigate the computational efficiency of PAA for large-scale problems.

- Explore the applicability and adaptations of PAA for other complex stochastic optimization scenarios.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrivate Optimal Inventory Policy Learning for Feature-based Newsvendor with Unknown Demand

Lan Wang, Tuoyi Zhao, Wen-xin Zhou

The Nonstationary Newsvendor with (and without) Predictions

Lin An, Andrew A. Li, Benjamin Moseley et al.

A note on compact and {\sigma}-compact subsets of probability measures on metric spaces with an application to the distribution free newsvendor problem

Óscar Vega-Amaya, Fernando Luque-Vásquez

No citations found for this paper.

Comments (0)